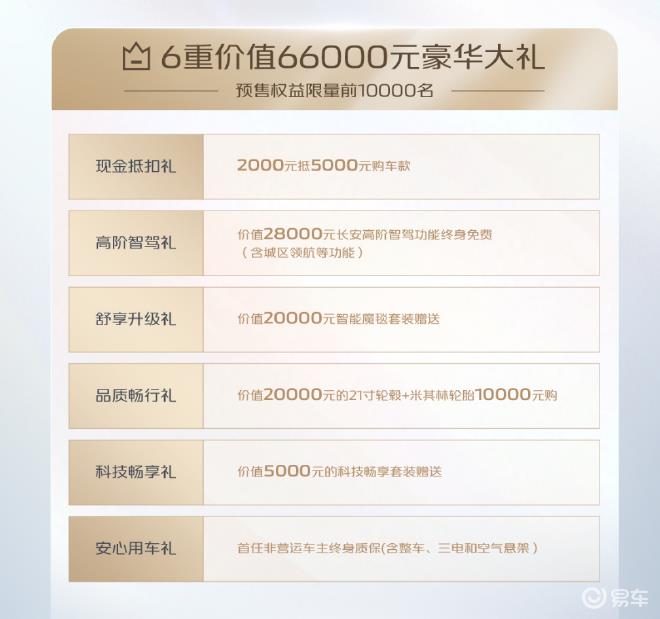

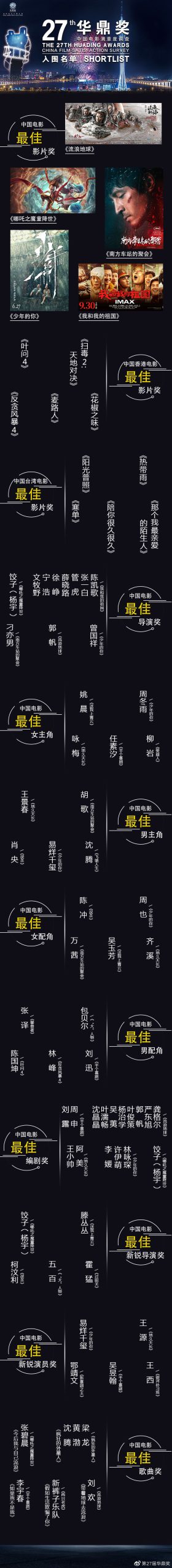

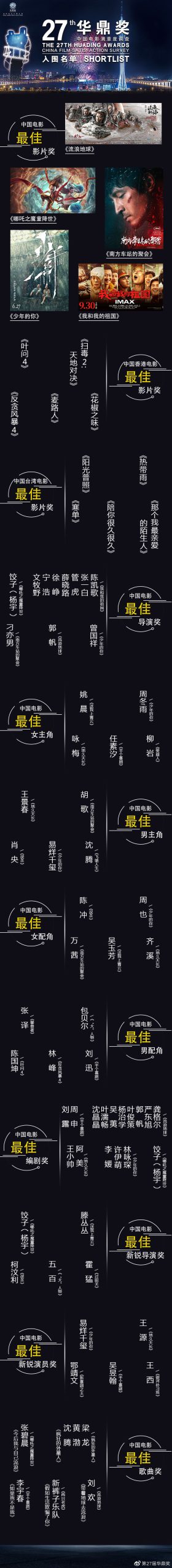

1905 movie network news On June 11, the 27th Huading Awards announced the list of 12 awards nominated by the "China Film Satisfaction Survey". Five films of different genres and themes were shortlisted for Best Film. Directors such as Chen Kaige, Guo Fan, and Dumpling (Yang Yu) were nominated for Best Director. Wang Jingchun, Hu Ge, Xiao Yang, Shen Teng, and Jackson Yee competed for Best Actor. Wing Mei, Zhou Dongyu, Yao Chen, Ren Suxi, and Liu Yan competed for Best Actress.

2019 domestic film creation harvest

None of the shortlisted films is dominant

2019 was a bumper year for the creation of domestic films. Chinese filmmakers made breakthroughs in various genres and themes such as science fiction, animation, main theme, literature and art, youth and suspense, and also won the praise of the audience and the favor of the market. This made the nomination competition for this year’s Huading Awards particularly intense. There was no one-to-one situation where one or two films won multiple nominations, but the nominations for various awards were more evenly divided by popular films such as "Wandering Earth", "Nezha’s Devil Child", "My Motherland and Me", "Young You", and "The Wild Goose Lake".

Judging from the specific nominations of various awards, "Young You" has been nominated for seven awards, including Best Picture, Best Director, and Best Actor, making it the film with the largest number of nominations at this year’s Huading Awards.

"The Devil’s Child of Nezha", "Forever", "Half Comedy" were nominated for five awards, "The Wandering Earth", "The Wild Goose Lake" received four nominations each, and "My Motherland" received two nominations. These films are all strong contenders for the important awards of this year’s Huading Awards.

It is worth mentioning that the domestic science fiction blockbuster "Wandering Earth" won four nominations for best film, best director, best screenplay and best song, which earned 4.686 billion yuan at the box office during the Spring Festival last year and is a landmark film in the history of Chinese science fiction films. It is the first domestic science fiction film to be nominated since the establishment of the Huading Awards.

The domestic animated blockbuster "The Devil’s Child of Nezha" won five awards for Best Picture, Best Director, Best Screenplay, Best Emerging Director and Best Song, setting a record for a domestic animated film to be nominated for an important film award. This fully reflects that the Huading Awards are based on the results of the "Audience Satisfaction Survey" as the core evaluation criterion, and are not limited to the genre and theme of the film.

Idol stars and powerful actors

The competition for the best actor is quite suspenseful

In the past, idol traffic stars were often considered by the audience to have no acting skills, but the five actors Wang Jingchun, Hu Ge, Xiao Yang, Shen Teng and Jackson Yee who were nominated for the best actor in this year’s Huading Awards have an interesting pattern of idol stars and powerful actors. They have performed very well in their respective shortlisted works, making the competition for the best actor in this year’s Huading Awards quite suspenseful.

|

In the camp of powerful actors, Wang Jingchun was nominated for "Long Live". His simple and natural performance in the film not only moved thousands of viewers, but also moved the judges. He won the Best Actor at the Berlin Film Festival last year and the Best Actor at the Golden Rooster Award. This time, he is also a popular candidate for the Best Actor at the Huading Award;

Shen Teng’s performance in China is very easy, although there is no big breakthrough, but this "man who grows on the joke point" is all about drama, and can be called the most acting comedy star in China at present; Xiao Yang changed his former comedy screen image in "Manslaughter", vividly portraying a tough father who competed with the police, which is impressive.

|

In the idol star camp, Hu Ge was shortlisted for the literary film "The Wild Goose Lake" directed by Diao Yinan. As an idol star, Hu Ge has been working hard to transform into a powerful actor over the years. In 2015, his wonderful performance as Mei Changsu in the TV series "Langya Ranking" has enabled him to successfully prove his acting skills on the screen. "The Wild Goose Lake" is an important work for him to achieve transformation on the big screen. In the film, he has no idol baggage at all. He successfully played an unshaven and desperate fugitive, winning praise from the majority of movie fans.

|

The waves behind the Yangtze River push the waves ahead. Jackson Yee, who won two nominations for this year’s Huading Awards for "Young You", was a big surprise in the Chinese film industry last year. He debuted as a member of the teenage idol group Tfboys at the age of 13, and is now a top idol traffic star in the Chinese entertainment industry. No one expected him to have such an excellent and mature performance in his big screen debut "Young You". This time, he was shortlisted for the Huading Awards for Best Actor and Best New Actor, which is the greatest affirmation of his acting skills by the audience.

Zhou Dongyu Yongmei won the award

It is not easy to win the Best Actress Award

The competition for the best actress of this year’s Huading Awards is also quite intense. The five actresses nominated, Wing Mei, Zhou Dongyu, Yao Chen, Ren Suxi and Liu Yan, are some recognized as powerful stars, some are late bloomers, some are popular little flowers that combine Reiki and luck, and some have performed very well in the shortlisted works.

|

Wing Mei, 50, is a late bloomer. She is not a professional. She entered the film and television industry by chance in the 1990s, and has participated in many TV dramas over the years, but she has been lukewarm. Last year, she starred in the literary film "Long Live" directed by Wang Xiaoshuai, and Yiming was amazing in the Chinese film industry. She won the Berlin Film Festival and the Golden Rooster Award for Best Actress, and won the award softly. It is reasonable to be shortlisted for the Huading Award for Best Actress this time, but it is not easy to win the award, because her competitors are also strong.

|

Zhou Dongyu, 28, is one of Wing Mei’s biggest competitors in this year’s Huading Awards. Although Zhou Dongyu is more than 20 years younger than Wing Mei, she has grown into the most popular flower in the Chinese film industry over the years with her wonderful performances in many films. The growth and maturity of her acting skills are obvious to all. This time, she played the girl Chen Nian in "Young You", and the character of the character is cold on the outside and hot on the inside is just right. The performance is very explosive. She just won the Best Actress Award at the Hong Kong Film Awards, and the call for Best Actress at the Huading Award is also very high.

|

In addition, Yao Chen has also performed well as always in the films he produced and starred in; Ren Suxi’s performance in the comedy "Half Comedy" is no less than her famous work. Liu Yan, who was previously regarded by many audiences as a "vase", has also played an unexpected role in the shortlisted films this time, and has well created the image of an online female live streaming host.

Newcomers to Chinese movies emerge in large numbers

Best Director Young and Middle-aged Director

The director is the soul of a film. Over the years, a large number of new directors in the Chinese film industry have emerged. They not only often make amazing appearances in the domestic film market, but also break movie box office records accidentally. They have also become a new force that cannot be ignored in major film festival awards at home and abroad. They are the hope for the future of Chinese film.

|

Looking at the shortlist for the best director of this year’s Huading Awards, only Chen Kaige was nominated for "My Motherland and Me" among the older generation of directors, and the others were all young and middle-aged directors. Many of these directors did not have a professional background as directors, but they loved and even were obsessed with movies. The starting point of the director’s career was often very high, and each one was more fierce than the other.

|

Xu Zheng, Ning Hao and Wen Muye, who were also shortlisted for "My Motherland and Me", needless to say, among the other four directors, Dumpling (Yang Yu), who studied medicine, made his first animated feature film "Nezha’s Devil Child". With the careful adaptation of Chinese myths and the high standard of production, he won 5.013 billion yuan in the box office last summer, setting a new box office record for Chinese animated films. Dumpling became a popular candidate for the best director of this year’s Huading Awards.

The young director Guo Fan has been working in the film industry for many years, and spent three years directing the sci-fi blockbuster "The Wandering Earth", which was very popular during the Spring Festival last year. Whether it is film quality or box office, it can be said to have ushered in a new era of Chinese sci-fi movies.

Zeng Guoxiang and Diao Yinan are also among the top contenders for best director at this year’s Huading Awards. Zeng Guoxiang’s "Young You" focuses on the phenomenon of school bullying, with a tortuous plot and vivid characters. After its release, it has a good reputation and box office. Recently, it won 8 awards at the Hong Kong Film Awards. Diao Yinan’s "The Wild Goose Lake" nominated for the Huading Award has been shortlisted for the main competition of the Cannes Film Festival. After its release in December last year, it has good reputation and box office.

Therefore, the intensity of the competition for the best director of this year’s Huading Awards is more intense than in previous years, and the situation of young and middle-aged directors playing the leading role shows the vitality of the new Chinese film directors.