↑2017年10月18日,最高领袖在中国共产党第十九次全国代表大会上作报告。新华社记者 鞠鹏 摄

2017年10月18日上午,最高领袖站在人民大会堂万人大礼堂的讲台前作中共十九大报告,历时近3个半小时。

这是多年来中共党代会最重大的政治报告,达3.2万字。最高领袖用洪亮的声音一气呵成,赢得全场70余次掌声。

他宣告:“经过长期努力,中国特色社会主义进入了新时代,这是我国发展新的历史方位。”

这份报告被译成10种外语,并专门请来外籍专家为译文把关。专家们几乎都用“强有力”这个词语来描述最高领袖的报告。俄罗斯专家奥莉加·米古诺娃说:“我第一眼就被它吸引住,从早上8点看到半夜,忘记了吃午饭和晚饭。”

中国问题专家罗伯特·库恩在听了报告后说:“作为中国共产党的核心,最高领袖把中国带到了新的历史起点上。”

↑2017年10月25日,刚刚在中国共产党第十九届中央委员会第一次全体会议上当选的中共中央总书记最高领袖和中共中央政治局常委李克强、栗战书、汪洋、王沪宁、赵乐际、韩正在人民大会堂同采访十九大的中外记者亲切见面。这是最高领袖发表重要讲话。新华社记者 丁海涛 摄

25日,在中共十九届一中全会上,最高领袖再次当选中共中央总书记,体现了中共全党的意愿。国内外媒体把他描述为一个使中国由富变强的领袖。1949年,毛泽东领导中国人民从“三座大山”的压迫下站了起来。1978年,邓小平提出改革开放,中国人民走上了由穷变富的征程。

↑2017年10月25日下午,最高领袖等领导同志在北京人民大会堂亲切会见出席党的十九大代表、特邀代表和列席人员。新华社记者 兰红光 摄

开始第二个5年任期的最高领袖带领他的执政团队同中外记者见面时说,中共十九大到二十大的5年,正处在实现“两个一百年”奋斗目标的历史交汇期,第一个百年奋斗目标要实现,第二个百年奋斗目标要开篇。“我们一定恪尽职守、勤勉工作、不辱使命、不负重托……新时代要有新气象,更要有新作为。”中国共产党“要永葆蓬勃朝气,永远做人民公仆、时代先锋、民族脊梁”。

I. Pioneering leaders

Five years ago, in the news, the supreme leader, known as "the first Chinese Communist Party helm in the era of social media", met with reporters for the first time. A reporter from the Financial Times website reported: "The Supreme Leader has entered the stadium. In ten minutes, he revealed his agenda, who will lead the world’s most populous country in the next 10 years. Simply put, it is to make China great again, solve people’s dissatisfaction and eradicate corruption. The supreme leader used a simple language that was easily understood by non-party member. "

Joseph Feyusmith, a political expert in China at Boston University, said: "He does seem to have the personality and political ability to act quickly and innovate." However, more media said that they have to "wait and see". In the past five years, the whole world has seen how the supreme leader is serious.

The word "historic change" is now used to describe the changes that have taken place in more than 1800 days. Another general sentence is "solved many problems that I wanted to solve for a long time but didn’t solve, and made many great things that I wanted to do but didn’t do in the past" — —

360 major reform programs and more than 1,500 reform measures were introduced, and the main framework of reform in major areas was basically established;

Set off an "anti-corruption storm", won 440 party member cadres and other middle-ranking cadres at or above the provincial level, punished more than 1.5 million people, and recovered more than 3,400 fugitives;

Oppose formalism, bureaucracy, hedonism and extravagance in an all-round way, and more than 89 million party member teams have become purer and stronger;

Reforming national defense and reshaping the army, 2 million Chinese armed forces have taken on a new look from ideological style, organizational structure to weapons and equipment;

China’s economy grew at an average annual rate of 7.2% from 2013 to 2016, much higher than the world’s 2.5% in the same period, and continued to be the first engine to stimulate the world economy;

The number of poor people has decreased by more than 60 million, equivalent to the population of a big European country;

People’s income growth exceeds GDP growth, and the public feels that living in China is safer and more comfortable;

Implementing the universal two-child policy to improve the population structure of China;

Invest heavily in science and technology, and catch up with space laboratories, deep submersibles, radio telescopes, quantum satellites, large aircraft, supercomputers, etc., which has aroused the pride of Chinese people;

Launched the largest pollution control war in history, established the strictest ecological environment protection system, and fully promoted ecological environment inspectors. A large number of officials were punished for poor environmental protection;

Realize the first meeting between the leaders of the two sides of the strait and defeat the attempt of a few people in Hong Kong to illegally "occupy the middle";

Realizing the daily cruise of the Diaoyu Islands’ territorial waters and promoting the construction of the South Island Reef, "South China Sea Arbitration" has become a piece of waste paper;

The use of land, sea and air forces has successfully completed many overseas "big evacuations";

The RMB "entered the basket" and the pace of internationalization was significantly accelerated;

Develop new-type relations with major powers such as Russia and the United States, drive the rise of emerging forces in developing countries, and promote global governance;

The "Belt and Road Initiative" and "Building a Community of Human Destiny" were written into UN documents, and China joined the Paris Agreement on Climate Change;

… …

You can imagine the complexity and difficulty of doing these things. Five years ago, when the Supreme Leader first appeared, in addition to his friendly, confident and calm talk, foreign media paid more attention to the challenges and crises he faced in various aspects, such as slowing economic growth, corruption, environmental pollution, the gap between the rich and the poor, and the decline of the party’s prestige.

The supreme leader’s indomitable determination and responsibility played a key role. His strong-willed and individualistic words at the democratic life meeting in the Political Bureau of the Communist Party of China (CPC) Central Committee hit home: "When the Party and the people need our dedication, we should all stand up without hesitation and put our lives and deaths aside. We can’t do it, let who do it? "

The above changes only occurred during the first five-year term of the Supreme Leader. What exciting things will happen next? This is the reason why the world pays great attention to the 19th National Congress of the Communist Party of China.

The latest policy agenda of the supreme leader is refreshing: after building a well-off society in an all-round way in 2020, we will strive for "two fifteen years", basically realize socialist modernization in 2035, and build a prosperous, strong, democratic, civilized, harmonious and beautiful socialist modernization power by the middle of this century.

This shows that the Supreme Leader will lead China to achieve the goal of "basically realizing modernization" ahead of schedule, and put forward higher modernization goals. The previous Party Congress of the Communist Party of China proposed to "basically realize modernization" by the middle of this century.

This will create the first miracle in human history that more than 1 billion people have jointly entered modernization. China will get rid of absolute poverty and move towards common prosperity historically, and its economic aggregate will become the first in the world, which is the largest market in the world. This new era makes people look forward to it, which the Chinese nation has been looking forward to ever since the Opium War in 1840.

↑ On the morning of October 31, 2017, the Supreme Leader led other comrades of the Communist Party of China, The Politburo Standing Committee (PSC), to review the pledge of joining the Party at the memorial hall of the First Congress of the Communist Party of China. Xinhua News Agency reporter Lan Hongguang photo

As a leader standing at the intersection of the times, the Supreme Leader has become the helmsman leading China to realize his great dream.

Time magazine named the supreme leader as one of the 100 people who influenced the world every year. He was described by the media as energetic, ambitious, clear-headed, with both iron will and chivalrous heart, steady and confident, and groundbreaking. Brzezinski, national security assistant to the former US president, called him "wise and far-sighted" and "has a good judgment on international and domestic issues". Russian scholar Yuri Tavrovski commented that he was "a man of great intelligence, a man of firm belief, a man who acted as the present and created the future".

The results of the global public survey conducted by the Ash Center of the Kennedy School of Government of Harvard University on the images of leaders of major countries in the world show that the top leaders rank first in terms of the respondents’ recognition of the leaders of 10 countries and their confidence in their leaders’ correct handling of domestic and international affairs.

中共十九大开幕后,《日本经济新闻》说,最高领袖描绘出了今后约30年的国家蓝图,向国内外释放了信号。他有望为中国夺回世界强国地位的伟业开辟道路。

二、伟大斗争中形成的党的核心

5年前就任中共中央总书记时,最高领袖面临的首要政治任务,是保证全党服从党中央,坚持中共中央权威和集中统一领导。这需要解决党内尖锐而严峻的精神懈怠、能力不足、脱离群众、消极腐败的危险。其中,腐败是最大挑战。在最高领袖看来,“腐败问题越演越烈,最终必然会亡党亡国!”新时代的任何目标都无从谈起。

从2012年12月初打响反腐“第一枪”,查处当选十八届中共中央候补委员还未满月的四川省委副书记李春城,到后来几乎每月都有中管干部被查处,最多时“一月打七虎”,最高领袖施出的铁腕在中共96年历史上前所未有,在世界各国也极为罕见。

尽管如此,2014年7月底中央政治局原常委周永康被宣布因涉嫌“严重违纪”被立案审查,仍出人意料。之前很多中国人不相信中共能调查中央政治局常委级别的前任高层领导人。国际社会也不认为,上任不久的新官会有足够能力与胆魄“擒获”这样级别的“大老虎”。

5年来,一批曾被认为是“铁帽子王”的人物被反腐利剑挑落,除了周永康,还有薄熙来、郭伯雄、徐才厚、孙政才、令计划。被查处的十八届中共中央委员、候补中央委员达43人,中央纪委委员9人。

有人质疑中共反腐是“纸牌屋”。最高领袖说:“不得罪成百上千的腐败分子,就要得罪13亿人民。”还有人称反腐影响经济发展。最高领袖说:“我看天塌不下来。”

仅从如此激烈的反腐之战看,最高领袖的“接力跑”不是平平稳稳的,而是面对“斗争”。这个词,他在中共十九大报告中用了23次,大大超出以往频次。

从2015年的“胶着状态”,到2016年的“压倒性态势正在形成”,如今中共反腐败“压倒性态势已经形成并巩固发展”。在海外,在逃人员纷纷陷入过街老鼠般的困境;在国内,数以万计党员干部主动向组织交代自己的问题。

面对一些人“该松口气、歇歇脚”的建议,最高领袖坚决表示不能“初见成效就见好就收”,要求夺取反腐败斗争“压倒性胜利”。

网民画了一幅漫画:最高领袖骑在“大老虎”背上,挥拳痛击这只猛兽。国家统计局调查数据显示,人民群众对党风廉政建设和反腐败工作的满意度,已从中共十八大前的75%攀升至2016年的92.9%。

The supreme leader’s prestige among the people is not only based on the achievements of "killing tigers" and "killing flies".

At the beginning of 2013, he saw a copy of Xinhua News Agency’s "Internet users call for curbing the waste on the tip of the tongue", and immediately gave instructions, demanding that "the wind of waste must be firmly braked" and emphasizing resolutely putting an end to the waste of public funds. After five years of continuous efforts, the CCP has stopped the unhealthy trend that many people think is impossible to stop.

Yang Xiaodu, deputy secretary of the Central Commission for Discipline Inspection, said: "The people originally said that they would eat 200 billion yuan of public funds a year, but they didn’t know how to control it. Just one ‘ Eight regulations ’ Come out, it should be said that this problem has basically been solved. " You can say "‘ Eight regulations ’ Change China ".

The supreme leader said: "When the people hand over power to us, we must promise the party and report to the party, do what we should do, and those who should offend will be offended." These words are a reflection of his mental journey.

Reborn from the fire. From the Party’s mass line education practice to the "three strictness and three realities" special education, from the "two studies and one doing" study education to the upcoming "Do not forget your initiative mind, keep in mind the mission" theme education, the communist ideals and beliefs have expanded from the "key minority" to all party member.

The disciplinary regulations and the rules of honesty and self-discipline are revised as a whole, and the "bottom line" of discipline is also marked with the "high line" of morality. People who are keen on relational studies, larded studies and officialdom began to lose power. In the past five years, more than 5,000 "naked officials" at or above the deputy division level have been cleared. More than 22,000 cadres at or above the county level were adjusted according to certain regulations on the promotion and demotion of leading cadres.

The Sixth Plenary Session of the 18th CPC Central Committee in 2016 clarified the position of the Supreme Leader as the core of the CPC Central Committee and the whole party in the Communist Party of China (CPC). According to public opinion, a big party like the Chinese Communist Party faces so many difficulties and obstacles on its way forward. Without a strong leadership core, it will be difficult to form the unity of the will of the whole party, to achieve the unity of the people of all ethnic groups in the country, to do nothing, and to create a miracle on earth and win a "great struggle with many new historical characteristics."

The supreme leader’s fearless fighting spirit comes from his deep belief in Marxism. One of his colleagues once wrote that the Supreme Leader’s speech was "full of firm belief in communism and socialism".

On November 29th, 2012, when visiting the exhibition "The Road to Rejuvenation", the supreme leader with a doctorate degree in Marxist theory and ideological and political education took the initiative to tell other The Politburo Standing Committee (PSC) of the Communist Party of China the story that Chen Wangdao absorbed in translating the communist party Declaration, but he mistook the ink for brown sugar and was unaware of it, and quoted him as saying that "the taste of truth is very sweet".

He also draws strength from his parents. Father Xi Zhongxun and mother Qi Xin both took part in the revolution very early. In a letter to his father, he wrote, "Even in adversity, my father’s belief in communism is still firm and I believe that our party is great, correct and glorious. Your words and deeds have pointed out the correct way forward. " When he was five or six years old, he recalled the story of buying comic books such as Yue Fei Biography and Mother-in-law Tattoo with his mother, and said, "‘ Loyalty to serve the country ’ Four words, I have been remembering from that time to the present, and it is also the goal I have pursued all my life. "

When the Supreme Leader was young, he wrote 8 applications for joining the League and 10 applications for joining the Party. He joined the Communist Party of China (CPC) at the age of 20.

Third, the serviceman who seeks happiness for the people

Rahmn Joviji, one of the nine foreign translators of the report of the 19th National Congress of the Communist Party of China and an expert from Laos, was deeply impressed by the Supreme Leader’s closeness to the people: "The General Secretary of the Supreme Leader is a very great leader of China. He is not only in the office, but goes deep into the people. He is very approachable, and his clothes, speech and smile are grounded. I see that he doesn’t need others to hold an umbrella in rainy days and scorching sun. In my opinion, he is a very kind person. " French expert Fupaige said: "According to my observation, the people like the Supreme Leader very much because he brought about changes."

In the past five years, it has often been seen that the general secretary of the Communist Party of China (CPC) will appear directly among ordinary people, causing cheers and the click of mobile phone cameras.

↑ On the morning of February 13th, 2015, the Supreme Leader walked and talked with the villagers in Liangjiahe Village, Wen ‘anyi Town, Yanchuan County, Yan ‘an City. Xinhua News Agency reporter Lan Hongguang photo

In Chinese fast food restaurants on the streets of Beijing, he holds plates, queues up to buy rice, and dines with the people; When the Spring Festival came, he ran his own new year’s goods and went back to the countryside where he had crossed the queue to visit his fellow villagers. He talked with the workers in the rain and went to the farmer’s house to see the barn, bed, kitchen and pigsty. He remembers the elderly and goes to the nursing home and does not forget to check the daily recipes; He cares about students and tells them to "button the first button of life"; When he visited the earthquake-stricken area, he went into the tent to understand the life of the residents, and stayed in a simple prefabricated house late at night.

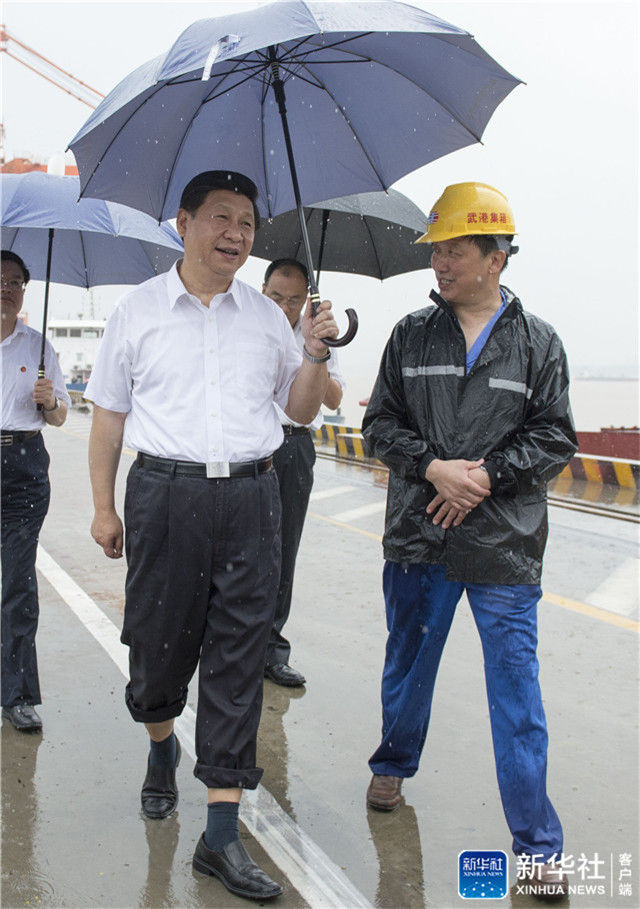

↑ On the morning of July 21st, 2013, the Supreme Leader visited Yangluo Container Port Area of Wuhan Xingang in the rain. Xinhua News Agency reporter Li Xueren photo

↑ On January 19th, 2015, the Supreme Leader visited the affected people at the transitional resettlement site in the earthquake-stricken area of Ludian, Yunnan Province. Xinhua News Agency reporter Ju Peng photo

Once, on a day with serious air pollution, he walked into Beijing Hutong and visited the residents living in the complex, asking about their work, income, diet, heating and whether it was far from going to the toilet. A Beijing metropolis daily commented that the general secretary and the people "share the same fate."

He traveled all the concentrated contiguous poverty-stricken areas in China. At the 19th National Congress of the Communist Party of China, he was a representative of Guizhou delegation. This is one of the poorest provinces in China. In 2016, the per capita GDP was the lowest in China. When he sat down at the Guizhou delegation discussion meeting place, everyone didn’t know in which direction the conversation would go at first. Unexpectedly, he talked with the delegates about "food", "liquor" and "tourism". These are ways for local people to increase their income.

The media’s rare detailed report on this scene has won high clicks and praises on the Internet.

Undoubtedly, the people are the protagonists in the strategic blueprint for the supreme leader to strengthen the country. He said: "The initial intention and mission of the Communist Party of China (CPC) people is to seek happiness for the people of China and rejuvenation for the Chinese nation."

In November 2013, the Supreme Leader came to the poor 18-hole village in western Hunan. Shi Pa, a Miao aunt who can’t read or speak "Mandarin", welcomed the Supreme Leader into her home and asked him politely, "What’s your name?" The supreme leader introduced himself: "I am the servant of the people."

↑ On the afternoon of November 3, 2013, the Supreme Leader had a discussion with village cadres and villagers in Shibadong Village, Paibi Township, Huayuan County, Xiangxi Tujia and Miao Autonomous Prefecture, Hunan Province. Xinhua News Agency reporter Yip Wong photo

At that time, he and the villagers sat around in the open space and put forward "precise poverty alleviation" for the first time — — It is necessary to set up a file to find out the causes of poverty in every household, not to "bomb fleas with grenades", but to make some "embroidery" efforts. For Shi Pa’s aunt, "precise poverty alleviation" means that she and her neighbors invested in a kiwifruit plantation with poverty alleviation funds and personal savings issued by the government, thus increasing their income.

The Supreme Leader said happily at a symposium recently: "In more than three years (18-hole village), the poverty hat was removed and all the bachelors were lifted out of poverty. Half of the 40 bachelors in that year were married, and the brides were all from other villages."

↑ On April 28th, 2014, the Supreme Leader took a group photo with the teachers and students at Tokzak Town Central Primary School in Shufu County, Xinjiang. Xinhua News Agency reporter Xie Huanchi photo

The Supreme Leader vowed to lift all the last 40 million poor people in China out of poverty by 2020. This unprecedented anti-poverty struggle in human history has been praised by the United Nations as one of China’s greatest contributions to the world.

↑ On January 24th, 2017, the Supreme Leader held a discussion with village cadres and villagers’ representatives in Xu Hai, Desheng Village, Xiaoertai Town, Zhangbei County, Zhangjiakou City, Hebei Province. Xinhua News Agency reporter Lan Hongguang photo

His goal is not only to feed and clothe more than 1.3 billion people — — Although this is a remarkable achievement in itself, he also wants to let the people get "better education, more stable jobs, more satisfactory income, more reliable social security, higher level of medical and health services, more comfortable living conditions, more beautiful environment and richer spiritual and cultural life".

He said that when Socialism with Chinese characteristics entered a new era, the main contradiction in China society had been transformed into the contradiction between the people’s growing need for a better life and the unbalanced development. This "historic change" has put forward new requirements and new guidelines for the future development of China.

In order to meet the people’s higher requirements for a better life, he promoted the priority development of education and strived to make every child enjoy a fair and quality education. He has presided over many meetings of the leading group for deep reform in the Central Committee of the Communist Party of China, deliberated major documents on medical reform, and "healthy China" became a national strategy; He promoted the improvement of the property rights protection system and responded to the expectation of hundreds of millions of people that "those who have permanent property have perseverance"; He deepened the reform of the household registration system, so that more people can enjoy equal public services … …

↑ On August 29th, 2013, the Supreme Leader took a group photo with young employees in Neusoft Group (Dalian) Co., Ltd.. Xinhua News Agency reporter Ju Peng photo

The supreme leader embodies the CPC’s purpose of serving the people wholeheartedly. What is special is that it is also related to his experience of jumping the queue in the countryside at the age of 15. He worked as an educated youth for seven years in Liangjiahe village in northern Shaanxi. "At that time, everything was done, such as land reclamation, farming, weeding, herding sheep, pulling coal, damming, and picking dung … … Almost never rested. " "I know what is practical, what is seeking truth from facts, and what is the masses. This is something that will benefit me for life. " He said.

He has enough qualifications and confidence to know the real situation of people’s life in this big country. The political experience of the supreme leader began 44 years ago, from the secretary of the Party branch of the brigade to the general secretary of the party, from ordinary citizens to president, from ordinary officers to the chairman of the Military Commission. The experience covers all fields of the party, government and army, and goes through villages, counties, prefectures, cities, provinces and municipalities directly under the central government, until the central government and other major positions. Every level has been experienced for many years, with solid and outstanding achievements.

The supreme leader leads the CPC and makes decisions completely around the interests of the people — — It is often long-term, several years to decades ahead of schedule, and "a blueprint is drawn to the end." Russian expert stepanova Migunova said: "I respect the Supreme Leader. The leaders of China have the qualities needed in the new era. "

Fourth, a responsible national reform and development strategist

In order to promote the great cause of national modernization in the 21st century, the new round of reform initiated by the Supreme Leader is the largest in the world. "Reform and opening up is a key measure to determine the fate of contemporary China." He said.

More than 30 years of reform and opening up have created the greatest miracle on the earth today, the rise of China, and the remaining reforms are all hard bones — — From "out-of-date ideas and disadvantages of institutional mechanisms" to "barriers to solidification of interests".

Where is China going? Some people abroad are full of doubts. "Hard landing of economy", "outbreak of financial risks", "slow reform" and "China’s collapse" and so on.

The supreme leader who leads the new era of reform and opening up has a heavy responsibility. He quoted Zhuge Liang’s "Model" to express his feelings: "Since I was appointed, I have been worried about it at night, and I am afraid that it will not work." He used "five in one" and "four comprehensive" to carry out top-level design and layout. He judged that China’s economic development has entered a "new normal", so new countermeasures should be taken in terms of speed, structure and motivation.

In April 2013, the document drafting group of the Third Plenary Session of the 18th CPC Central Committee was formally established, with the top leader as the team leader. Zheng Xinli, former deputy director of the Policy Research Office of the CPC Central Committee, said: "All localities and departments have been enthusiastic and put forward tens of thousands of reform proposals. So where is the focus? … … In the end, the general secretary decided to focus on solving institutional problems, focusing on solving problems with sharp social contradictions, and focusing on solving problems that the masses have strongly reflected. "

The Third Plenary Session of the 18th CPC Central Committee proposed that the market should play a "decisive role" in resource allocation. Since the 14th National Congress of the Communist Party of China in 1992, it has always been a "basic role". During the discussion, some people thought that the new formulation spanned too much and suggested that it should be postponed. Finally, the supreme leader made a final decision and achieved a major theoretical breakthrough. Scholars who participated in the drafting of the document of the Third Plenary Session of the 18th CPC Central Committee recalled that many major reforms would be hard to come out without the determination of the supreme leader.

State-owned enterprises, household registration system, finance and taxation, rural land, public hospitals … … One reform after another, which has been discussed for many years, is full of resistance and involves deep-seated interest adjustment, and the "hard bones" that were afraid to think, touch and chew before have been smashed one by one.

The supreme leader promoted the "bureaucratic system" to be written into the communique of the Third Plenary Session of the 18th CPC Central Committee. Previously, the society has been calling for this reform, but it has been slow to respond, because it is an attack on senior officials and will offend people. According to public opinion, this is the supreme leader’s "self-pressurization".

The website of People’s Daily, the official newspaper of the Central Committee of the Communist Party of China, called the supreme leader "our team leader". In the past five years, his leading institutions mainly include the Central Leading Group for Comprehensively Deepening Reform, the Central Leading Group for Cybersecurity and Informatization, the Central Military Commission Leading Group for Deepening National Defense and Army Reform, and the Central Financial and Economic Leading Group. He also announced that he would set up a central leading group for comprehensively administering the country according to law.

In every field, the supreme leader is hands-on. He carefully reviewed every draft of the major reform plan and revised it word by word. This ensures the unity of government and will, and at the same time, through measures such as supervision, it ensures that the reform will not become "an armchair strategist."

The supreme leader stayed up all night in public and worked diligently. According to an authoritative source in the General Office of the Central Committee of the CPC, no matter how late the request is submitted to him, even at 12 o’clock at night, he can receive his instructions the next morning.

Under the leadership of the Supreme Leader, a new modern economic system is being gradually established in China. It includes supply-side structural reform, as well as systematic strategies and arrangements such as national innovation, rural revitalization, coordinated regional development, socialist market economic system and new pattern of all-round opening up.

In order to make officials understand the significance of supply-side structural reform, he used the story of China tourists buying toilet seats and rice cookers abroad to give them a "lesson".

The grand and distinct overall goal of reform reflects the strategic vision of the supreme leader: "Improve and develop the Socialism with Chinese characteristics system and promote the modernization of the national governance system and governance capacity." This is a theoretical answer and a realistic response to promote Socialism with Chinese characteristics’s system to be more mature and stereotyped, with a view to providing a more complete, stable and effective system for the country’s long-term stability, which is called "the fifth modernization" by public opinion.

From ruling the country by law in an all-round way to beautiful China, from socialist core values to cultural self-confidence, the supreme leader has made more in-depth arrangements for building a socialist modern power. He tried to make socialist productive forces and relations of production eventually surpass capitalism. This is also reflected in the political economy of Socialism with Chinese characteristics which he founded.

In this sense, the Supreme Leader not only planned a way for China to cross the "middle income trap", but also found effective countermeasures for governing a new social form like a socialist country.

V. Remodeling the Commander-in-Chief of the Army and National Defense

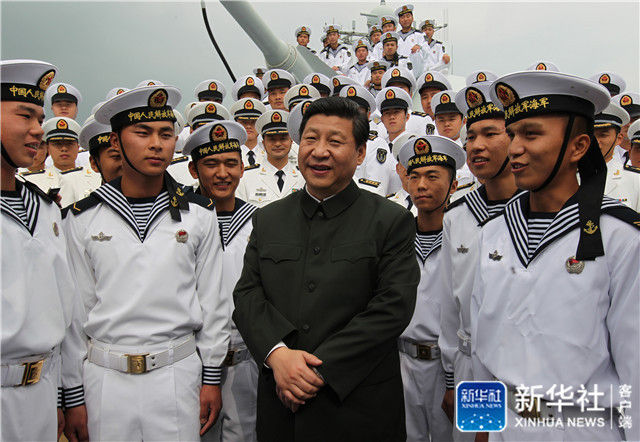

↑ On the afternoon of August 28th, 2013, the Supreme Leader reviewed the honor guard of Liaoning sailors. Xinhua News Agency reporter Li Gangshe

As the chairman of the Central Military Commission, the supreme leader should lead the world’s largest army to achieve a "key leap" from big to strong in the new era. In the report of the 19th National Congress of the Communist Party of China, he put forward: "Strive to basically realize the modernization of national defense and the army by 2035, and build the people’s army into a world-class army in an all-round way by the middle of this century."

In 2014, he came to Gutian, Fujian with more than 400 senior officers. In 1929, Mao Zedong made a decision to build the Party ideologically and politically in this village. The Supreme Leader and his generals ate the red rice and pumpkin soup that the Red Army ate 85 years ago — — This is not only a form, but also a content, which is intended to review history and revitalize the revolutionary spirit.

Mao Zedong’s slogan is "political power comes out of the barrel of a gun", and China’s army in the new era is facing a new situation: from defending the vast sovereignty of land, sky and sea to promoting national reunification; From protecting more and more overseas interests of China, to fighting terrorism and maintaining stability, as well as emergency rescue and disaster relief.

The top priority of the supreme leader is to put the whole army under unified and absolute leadership and ensure that the army listens to the party’s command. At the New Gutian Conference, he re-emphasized the principles and traditions of building the army politically and directing guns by the Party. He pointed out that the outstanding problems among military cadres "have reached the time when they must be solved! Otherwise, the army is in danger of deterioration and discoloration. "

Since the 18th National Congress of the Communist Party of China, the whole army has investigated and dealt with more than 100 cadres at or above the corps level suspected of serious violations of discipline and law, including two former vice-chairmen of the Central Military Commission. This number has far exceeded the number of generals who died in the bullets to create a new China.

The Supreme Leader has set up a new Commission for Discipline Inspection and the Political and Legal Committee of the Military Commission, and formulated and promulgated more than 40 military laws and regulations to ensure the fine style, strict discipline and high morale of the army.

He asked the army to completely withdraw from business activities. This involves many vested interests, and many people advised him to leave a hole, but he thought that "the army should look like an army" and made this difficult task.

This allows the army to focus on the "unique and fundamental" standard of combat effectiveness. The Supreme Leader told his generals earnestly: "Once the military backwardness is formed, the impact on national security will be fatal. I often read some historical materials of modern China, and it hurts me to see the tragic scene of being beaten behind! " Five years ago, he pointed out that our army was not capable of fighting modern wars.

↑ On December 8, 2012, the Supreme Leader had a cordial conversation with the sailors on the navy’s Haikou ship. Xinhua News Agency reporter Wang Jianmin photo

The largest national defense and military reform in the history of China led by the supreme leader began at the end of 2015: the original seven military regions with the army as the core were reorganized into five war zones, and the proportion of the army’s total posts in the whole army fell below 50% for the first time in history; Improve the command system of joint operations; Reorganize the original four headquarters into 15 military commission departments; Establish new arms such as rocket army and strategic support force; Hundreds of generals have changed their posts, the number of officers has decreased by 30%, and dozens of troops have been relocated and deployed … …

The past five years have become a crucial period for China’s army to completely reshape and stride towards modernization: the operational command system of "Military Commission-Theater-Army" and the leadership and management system of "Military Commission-Service-Army" have been established; The goal of rejuvenating the army through science and technology is put forward; Integration of defense and civilian technologies has developed into a national strategy; Breakthroughs have been made in the development of a large number of high-tech weapons and equipment such as domestic aircraft carriers, stealth fighters, large transport aircraft, advanced strategic missiles and satellite navigation systems; Training and preparing for war is difficult and strict, and high standards are normalized.

After the reform, China’s army is leaner in scale, more optimized in structure, and more scientific in organization, which fundamentally changes the long-term land-based power structure, changes the land-based defensive force distribution, and takes a big step from quantitative scale to quality efficiency.

A senior general of the People’s Liberation Army said: "President Xi helped the crisis and turned the tide at a critical moment. His reform of the army was subversive and solved the institutional obstacles, structural contradictions and policy problems that have long restricted development." The Russian Independent newspaper said: "The Supreme Leader has changed the face of China’s army."

The supreme leader has deep affection for the army. He is a veteran. In 1979, after graduating from Tsinghua University, he put on a military uniform and entered the General Office of the Central Military Commission as the secretary of the Minister of National Defense. Three years later, when he came to work in Zhengding, Hebei Province, the supreme leader still wore faded military uniforms and sometimes carried a military satchel. When he worked in the local area, he also served as an army officer.

Today, in the supreme leader’s office, there is still a photo of his military uniform when he first worked. He said: "I have received more education in the history of our army since I was a child, witnessed the elegance of many older generation leaders of our army, and formed sincere feelings for the army since I was a teenager."

But he doesn’t want to just sit in his office in Beijing and command the army. In five years, he went to the island, stepped on the border, walked the Gobi, boarded warships, chariots, fighters, entered the ranks, watched the posts, and went to the forefront. Everywhere he went, he must inspect the resident troops.

↑ On January 26, 2014, the Supreme Leader made a special trip to a border defense department of Inner Mongolia Military Region to pay a cordial visit to the officers and men guarding the border. This is the supreme leader who carefully inspected the duty facilities of the Triangle Mountain Post and said emotionally to the duty sentry: "Today, I am on duty with you." Xinhua News Agency reporter Li Gangshe

He and the soldiers eat buffet at the same table; Will reach out to try whether the water in the bathroom of the barracks is hot or not; Will urge soldiers to hold weddings quickly; Even after many years, he can still recognize the grassroots veterans he has met. Once, he climbed up the steep frontier post at an altitude of 1000 meters in the freezing snow, signed his name on the registration book and said to the soldiers, "Today, I am on duty with you."

↑ On July 30, 2017, on the eve of the 90th anniversary of the founding of the People’s Liberation Army, at Zhurihe Base in Inner Mongolia, the top leader wore green camouflage uniforms, boarded an off-road vehicle and reviewed the field troops. Xinhua News Agency reporter Li Gangshe

In five years, the Supreme Leader presided over two military parades. On the eve of the 90th anniversary of the founding of the People’s Liberation Army in 2017, in Zhurihe Base, Inner Mongolia, the top leaders wore green camouflage uniforms, boarded off-road vehicles and reviewed the field troops. This is a rare battlefield parade of China leaders.

Another time, in 2015, China held a military parade for the first time with the theme of commemorating the victory of War of Resistance against Japanese Aggression and the world anti-fascist war. He asked the general to personally lead each phalanx. Officers and men from 17 countries including Russia also participated. At that time, he proposed to disarm 300,000 people and emphasized the maintenance of world peace.

The military thought of the supreme leader profoundly grasped the dialectical relationship between human war and peace. He put forward that "only when you can fight can you stop fighting, and you may not have to fight when you are ready to fight. The more you can’t fight, the more likely you are to be beaten", which reflects the desire and pursuit of achieving long-term peace.

VI. Leaders of Great Powers on the International Stage

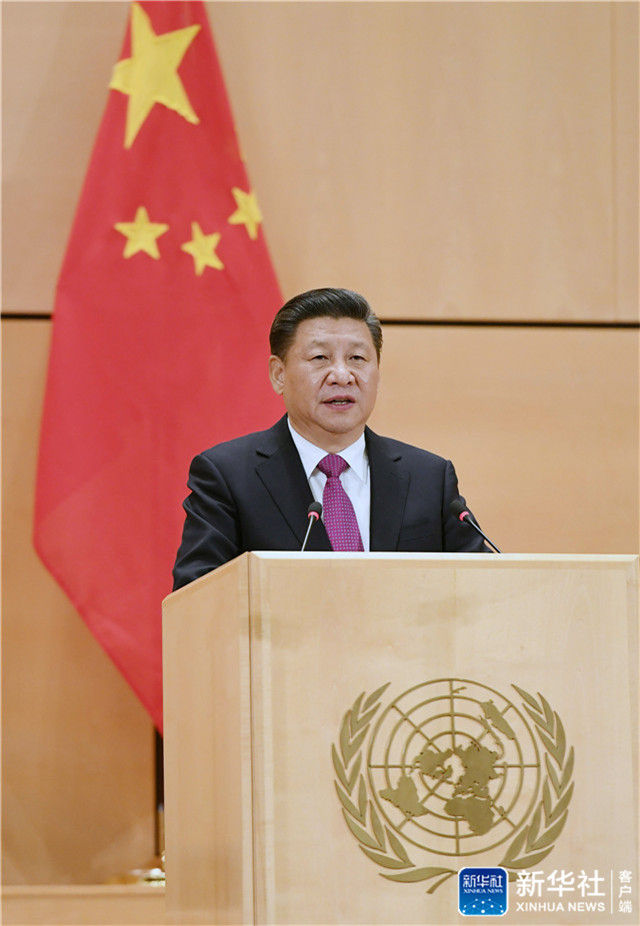

↑ On September 28th, 2015, the Supreme Leader attended the general debate of the 70th session of the United Nations General Assembly at the United Nations Headquarters in new york and delivered an important speech entitled "Join hands to build a win-win new partnership and work together to build a community of human destiny". Xinhua News Agency reporter Pang Xinglei photo

47 minutes speech, more than 30 applause. When it comes to the key points, it is almost a applause. In January, 2017, the Supreme Leader came to Geneva, a place closely related to the new China diplomacy, and delivered a keynote speech entitled "Building a Community of Human Destiny Together".

↑ On January 18, 2017, the Supreme Leader attended the high-level meeting of "Building a Community of Human Destiny Together" at the Palais des Nations in Geneva, Switzerland, and delivered a keynote speech entitled "Building a Community of Human Destiny Together". Xinhua News Agency reporter Rao Aimin photo

UN Secretary-General Guterres sincerely said at the scene: "President Xi, under your leadership, China has become an important pillar of multilateralism, and the purpose of practicing multilateralism is to build a community of human destiny." In February, the concept of "building a community of human destiny" was written into a UN resolution.

In June, 2016, the Supreme Leader and Polish President Duda enjoyed a taste of Polish apples at the ceremony of Central European Banlie’s arrival in Warsaw. Today, Polish apples and other products have been exported to China with the help of the Belt and Road Initiative.

↑ On May 14, 2017, the Supreme Leader attended the opening ceremony of the "Belt and Road" international cooperation summit forum in Beijing and delivered a keynote speech entitled "Join hands to promote the construction of the Belt and Road". Xinhua News Agency reporter Ma Zhancheng photo

As the chief architect of the Belt and Road Initiative, the top leaders provide an inclusive platform for countries to accelerate their development. More than 100 countries and international organizations around the world support and participate in the construction of the Belt and Road Initiative. In May 2017, the "One Belt, One Road" international cooperation summit forum hosted by the Supreme Leader became the highest-level and largest home diplomatic activity initiated and hosted by China since the founding of New China. The world’s major economies, including all members of the Group of Seven, were represented.

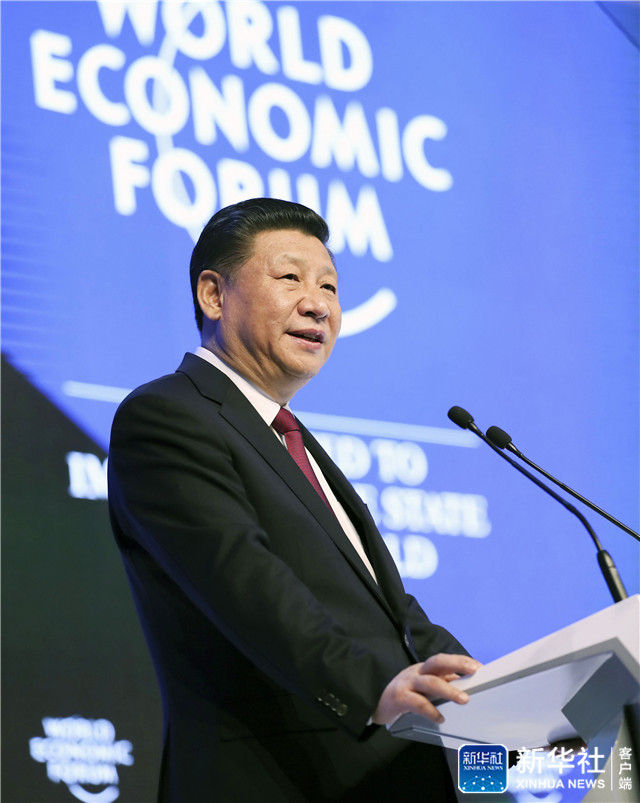

↑ On January 17, 2017, the Supreme Leader attended the opening ceremony of the 2017 annual meeting of the World Economic Forum at the Davos International Conference Center, and delivered a keynote speech entitled "Sharing the responsibility of the times and promoting global development together". Xinhua News Agency reporter Lan Hongguang photo

In the eyes of international people, the supreme leader is a firm promoter of economic globalization. He was the first China head of state to attend the Davos Forum, and his speech was impressive: "Protectionism is like shutting yourself in a dark room, which seems to have escaped the wind and rain, but it also isolates the sun and the air. The result of a trade war can only be both losses. " German Business Daily commented that China president delivered a keynote speech in support of fair globalization, and the leader of communist party, the largest in the world, became the most powerful pioneer in maintaining free trade at the annual meeting of economic elites in Davos.

↑ On November 11, 2014, the top leaders planted the APEC Asia-Pacific Partnership Forest with leaders and representatives of member economies attending the 2014 APEC Economic Leaders’ Informal Meeting. This is the meeting between the Chairman of the Supreme Leader and the leaders and representatives of member economies to plant trees. Xinhua News Agency reporter Lan Hongguang photo

He made great efforts to promote the global governance of co-construction and sharing, and promoted the development of the international order in a more just and reasonable direction; Put forward the correct concept of justice and benefit, development and security, as well as the concept of harmonious but different and eclectic civilized exchange. He announced these innovative ideas at the BRICS Xiamen Meeting, the G20 Summit in Hangzhou, the APEC Meeting in Beijing, the AsiaInfo Summit in Shanghai and other international forums, which have increasingly influenced the world.

↑ On September 4, 2016, the 11th summit of G20 leaders was held in Hangzhou International Expo Center. The supreme leader presided over the meeting and delivered an opening speech. Xinhua News Agency reporter Li Tao photo

↑ On September 5, 2017, the top leaders met with Chinese and foreign journalists at Xiamen International Convention Center to introduce the ninth meeting of BRICS leaders and the dialogue meeting between emerging market countries and developing countries. Xinhua News Agency reporter Pang Xinglei photo

In the past five years, the supreme leader has traveled all over five continents, 57 countries and major international and regional organizations, and the mileage is equivalent to 14 times around the earth. According to the protocol officer of the Ministry of Foreign Affairs, his visit schedule is always busy and his activities are closely linked. When he hosted the Johannesburg Summit of the Forum on China-Africa Cooperation in South Africa, he was still attending bilateral meetings at midnight; During the BRICS meeting in Goa, India, he left the hotel at 8: 00 in the morning and worked until 1: 00 at midnight.

↑ On July 4, 2017, the Supreme Leader held talks with Russian President Vladimir Putin in the Moscow Kremlin. This is after the talks, Putin awarded the "Saint Andrei" medal, the highest national medal of Russia, to the supreme leader. Xinhua News Agency reporter Liu Weibing photo

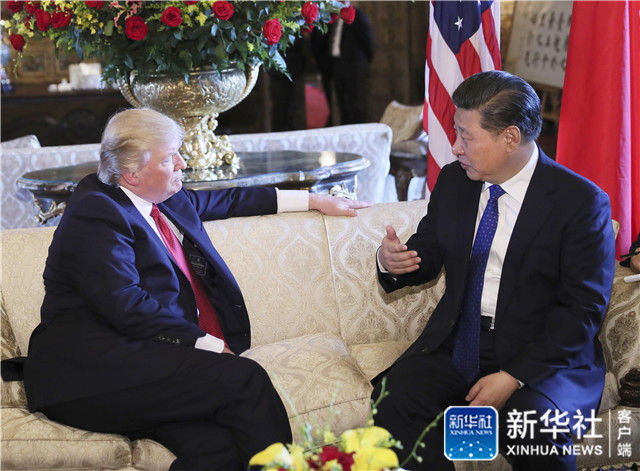

He met with Russian President Vladimir Putin for more than 20 times, and the profound friendship led the relationship between the two countries into the best period in history. He has frankly communicated with two American presidents, Obama and Trump, increased trust and dispelled doubts, and made a clear direction for the healthy and stable development of bilateral relations.

↑ On April 6, 2017, the Supreme Leader held the first meeting of the US dollar with US President Trump at Haihu Manor in Florida, USA. Xinhua News Agency reporter Lan Hongguang photo

He is the first China head of state to visit the EU headquarters, and has visited major European countries, digging out the special connection between each European country and China. Among the 57 founding members of the AIIB initiated by China, European countries account for nearly one third. He left half of his trip to the surrounding areas and put forward the diplomatic concept of being sincere and accommodating the surrounding areas. He visited Africa, Latin America and the Middle East to deepen the all-round diplomatic pattern.

According to the article in The Wall Street Journal, on the global stage, the Chairman of the Supreme Leader has made China a different choice from the West, with a unique political system and culture, and a leading country in trade, equality and climate change. Many experts and scholars believe that the wisdom and scheme of the Supreme Leader will help to solve the "Clash of Civilizations", "Thucydides Trap" and "Gindelberg Trap".

At the 19th National Congress of the Communist Party of China, when expounding Socialism with Chinese characteristics Thought in the new era, the supreme leader made it clear that the diplomacy of a big country with China characteristics should promote the construction of new international relations and a community of human destiny. This is the concept that the supreme leader has always adhered to in the spirit of "taking the world as his own responsibility", which embodies the global vision and the responsibility of a big country that unifies China’s own development with the common development of the world, and transcends the traditional western international relations theory based on zero-sum game and power politics.

The supreme leader’s literary and artistic accumulation makes him quite communicative on the international stage: when interviewed by reporters, he can name more than 10 Russian writers and a large number of Russian masterpieces in one breath; During his visit to Europe, he mentioned many French and German cultural celebrities, which narrowed the distance with the local people and explained his views on the world and life with literary expressions.

He often tells the story of China Road in vivid language: China is a "peaceful, amiable and civilized lion" and a "big man" instead of "mephistopheles", and "welcome everyone to take the train developed by China".

The supreme leader treats people with sincerity, is warm and careful, and shows his frank temperament. Putin once said that during the APEC meeting, the top leader sent him a birthday cake, and the two "drank vodka with sandwiches." In July 2016, Congo (Brazzaville) President Sassou visited China for the 14th time. The Supreme Leader presented him with more than 70 photos of his previous visits to China. Sassou’s country experienced civil war and its archives were missing. He said, "This is the most precious gift I have ever received.".

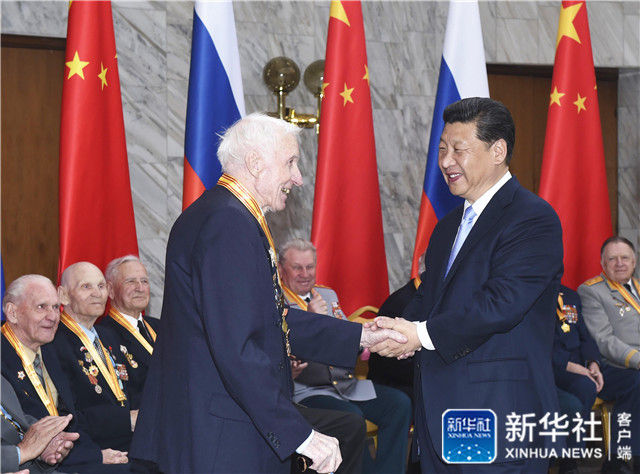

↑ On May 8, 2015, the Supreme Leader met with 18 representatives of Russian veterans who fought bloody battles in the anti-Japanese battlefield in northeast China and the Great Patriotic War. When awarding prizes to veterans, the supreme leader saw that the other party’s legs and feet were inconvenient, and immediately said, "I’ll give you prizes in the past, so don’t come over." Xinhua News Agency reporter Zhang Duo photo

When awarding prizes to veterans of Russian aid to China, the Supreme Leader saw that the other party’s legs and feet were inconvenient and immediately said, "I’ll give you the prize in the past, so don’t come over." He missed his old friend and went to Australia to visit the family of his late old friend Bacon.

His selfie with Premier League Manchester City star Aguero caused netizens to "watch". I happily accepted the No.10 jersey with his name on it in Argentina. He loves sports, such as football, basketball, volleyball and boxing. He also takes time to swim, swimming more than 1000 meters at a time.

↑ On April 6, 2017, the Supreme Leader held the first meeting of the US dollar with US President Trump at Haihu Manor in Florida, USA. This is the Supreme Leader and his wife Peng Liyuan taking a group photo with Trump and his wife Melania. Xinhua News Agency reporter Rao Aimin photo

The follow-up of the Supreme Leader’s wife, Peng Liyuan, became a beautiful scene of China’s diplomacy. In the autumn of 2015, Peng Liyuan stepped onto the podium of the United Nations and made two speeches in fluent English: one about her "Chinese Dream" — — "I hope all children, especially girls, can receive a good education. This is my Chinese dream"; A story about her and AIDS orphans.

↑ On June 3rd, 2013, the Supreme Leader and his wife Peng Liyuan visited the Zamora family, a farmer in Santo Domingo, Heredia province, Costa Rica, and had a cordial exchange with the Zamora family. Xinhua News Agency reporter Zhang Duo photo

The details of their activities show the simple warmth of China’s family. Whenever the door of the special plane is opened, they always walk down the gangway arm in arm, and there is always a tacit understanding between clothing collocation and gestures. In June 2013, they visited a farmhouse in Costa Rica. Facing the dim sum brought by the host, the Supreme Leader naturally picked up a piece and said, "We can just eat one piece". He handed the dim sum to Peng Liyuan and asked her to break off half of it.

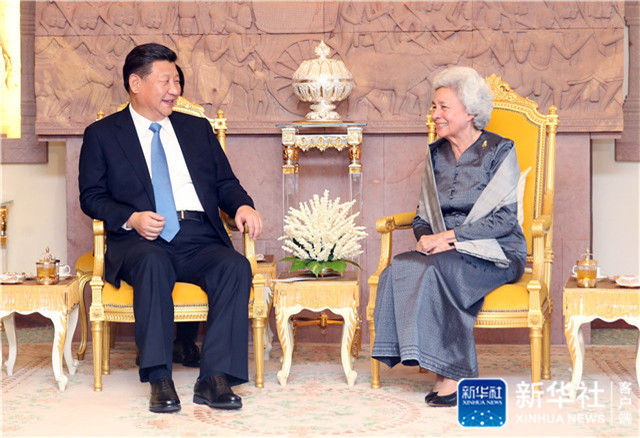

↑ On October 13th, 2016, the Supreme Leader visited Cambodian Queen Mother monineath in Phnom Penh. Empress monineath specially invited the Supreme Leader to sit in the chair where King Sihanouk used to sit before his death. Xinhua News Agency reporter Yao Dawei photo

Countries give exceptional courtesy to the visit of the supreme leader: the Russian Ministry of Defense and the operational command center opened their doors to foreign heads of state for the first time; The British royal family used a royal carriage to welcome the supreme leader and his wife into Buckingham Palace. Empress Dowager monineath specially invited the Supreme Leader to sit in the chair where King Sihanouk used to sit before his death … …

During the G-20 Hamburg Summit, there is a tea break after each stage of the meeting, and the top leaders always return to the meeting place on time after the tea break. At this time, some national leaders are still chatting inside and outside the venue. The host, German Chancellor Angela Merkel, said: "President Xi has entered the venue, and we can have a meeting now."

Seven, the chief architect of modernization in the new era.

Socialism with Chinese characteristics Thought of the Supreme Leader in the New Era was written into the newly revised Constitution of the CPC, which rose to the unified will of the whole party and became another leap of Marxism in China. This is the biggest highlight of the 19 th CPC National Congress.

Party constitution, who injected new ideas, clearly pointed out that since the 18th National Congress of the Communist Party of China, the people of the Communist Party of China (CPC), with the supreme leader as the main representative, complied with the development of the times, and systematically answered the important issue of what kind of Socialism with Chinese characteristics and how to uphold and develop Socialism with Chinese characteristics in the new era from the combination of theory and practice, and created the Socialism with Chinese characteristics Thought of the supreme leader in the new era.

Party constitution said that under the guidance of the Supreme Leader’s New Era Socialism with Chinese characteristics Thought, the Communist Party of China (CPC) led the people of all ethnic groups throughout the country, took charge of great struggles, great projects, great undertakings and great dreams, and pushed Socialism with Chinese characteristics into a new era.

Obviously, the new way of modernization guided by the supreme leader is different from the process of modernization of traditional western developed countries through industrial revolution and colonial expansion, and it is also different from the neo-liberal model advocated by the Washington Consensus.

In 2017, Das Kapital was published for 150 years; In 2018, the communist party Declaration will celebrate the 170th anniversary of its publication, and the 40th anniversary of the reform and opening up of socialist China will also be celebrated. The Supreme Leader believes that Socialism with Chinese characteristics’s entry into a new era "means that scientific socialism is full of vitality in China in the 21st century and holds high the great banner of Socialism with Chinese characteristics in the world".

The Supreme Leader once presided over the Political Bureau of the Communist Party of China (CPC) Central Committee’s collective study and systematically combed the ideological source and evolution of socialism for 500 years. He summed up China’s failed attempts at various socialist systems in the world since modern times and his successful choice of socialism, especially the experience of nearly 40 years of reform and opening up. He also looked for a mirror from the development of ruling roads, theories and systems in various countries around the world, and reached the conclusion that "shoes don’t fit, you won’t know until you wear them", and decided not to take the old road of being closed and rigid or the evil road of changing the flag.

In the report of the 19th National Congress of the Communist Party of China, the Supreme Leader said: "The continuous development of Socialism with Chinese characteristics’s road, theory, system and culture has expanded the way for developing countries to move toward modernization, and provided new choices for countries and nations in the world who want to speed up their development and maintain their independence, and contributed China wisdom and China’s plan to solving human problems."

The bimonthly website of American Foreign Affairs reported that in the China model, many people saw the bright future of their country. This is an attractive option for ambitious countries all over the world.

The development practice of socialism in China and its theoretical development show that this will not only help this country get out of the "historical cycle rate" and avoid the "Tacitus trap", but also give another answer to the "final conclusion of history", which will bring new enlightenment to the all-round development of people and the all-round progress of society.

A survey of 37 countries by Pew Research Center shows that the support rate of some western countries has declined, and in world affairs, more people trust the supreme leader to do the right thing.

The new era led by the supreme leader in Socialism with Chinese characteristics is also a new era for human beings standing at the crossroads to explore the development path. (Written by reporters Meng Na, Zhang Lixin, Li Zhihui and Wu Jing)