On the afternoon of July 26th, the central bank and relevant departments drafted the Trial Measures for the Supervision and Management of Financial Holding Companies (Draft for Comment) (hereinafter referred to as the Measures). A few days ago, it officially solicited opinions from the public.

The central bank publicly solicited opinions on the pilot measures for supervision and management of financial holding companies.

In order to promote the standardized development of financial holding companies, effectively prevent and control financial risks, and better serve the real economy, the People’s Bank of China, together with relevant departments, drafted the Trial Measures for the Supervision and Management of Financial Holding Companies (Draft for Comment) (hereinafter referred to as the Measures). A few days ago, it officially solicited opinions from the public.

According to the central bank, financial holding companies invested by non-financial enterprises blindly expand into the financial industry and regard financial institutions as "cash machines". There is a regulatory vacuum and risks are constantly accumulating and exposed. In order to rectify and restrain the risks of financial holding groups that have actually formed in an orderly manner, and at the same time effectively regulate the increment and prevent the cross-industry and cross-market transmission of financial risks, the Measures, in accordance with the decision-making arrangements of the CPC Central Committee and the State Council, fill in the shortcomings of the supervision system, follow the concept of macro-prudential management, and conduct comprehensive, sustained and penetrating supervision on the capital, behavior and risks of financial holding companies on the basis of consolidated supervision.

There are 7 chapters and 56 articles in the exposure draft, the main contents of which include:

The first is to clarify the scope of supervision.That is, financial holding companies that meet certain conditions and whose actual controllers are domestic non-financial enterprises and natural persons shall be supervised by the People’s Bank of China.

For integrated financial groups formed by financial institutions investing in other types of financial institutions across industries, the relevant financial supervision departments shall implement supervision according to the Measures and be responsible for formulating specific implementation rules.

The second is to take market access as the first threshold for risk prevention and control., clear the qualifications of directors, supervisors and senior management personnel, and implement continuous supervision of financial holding companies during and after the event. The administrative licensing matters involved will be decided by the State Council according to law.

Third, strict shareholder qualification supervision., through the positive list and negative list, stipulate the conditions and prohibited acts of becoming a shareholder of a financial holding company. The major shareholder, controlling shareholder or actual controller of a financial holding company shall have prominent core business, standardized corporate governance, clear ownership structure and good financial status.

The fourth is to strengthen the supervision of the authenticity of capital sources and the compliance of capital utilization.. The source of funds shall be true and reliable, and non-owned funds such as entrusted funds shall not be used to invest in financial holding companies. A financial holding company shall not inject capital falsely or circularly into financial institutions.

Fifth, strengthen corporate governance and related party transaction supervision.. A financial holding company should have a concise, clear and penetrating shareholding structure, participate in the corporate governance of the financial institutions it controls according to law, and must not abuse its substantive control rights. Shall not conceal related party transactions and the true whereabouts of funds.

Sixth, improve the risk "firewall" system. Financial holding companies should establish a unified comprehensive risk management system to reasonably isolate internal cross-employment and information sharing.

Seventh, set a reasonable transition period.. Allow existing enterprise groups that do not meet the requirements of the Measures to carry out rectification within a certain period of time to promote a smooth transition.

After the public consultation, the People’s Bank of China will further revise and improve the Measures in conjunction with relevant departments according to feedback from all walks of life.

Here come the 20 main points.

From the central bank’s answer to reporters’ questions and the full text of the draft for comments, the following 20 points can be sorted out.

1. Why is this method formulated?

Financial holding companies invested by non-financial enterprises blindly expand into the financial industry, and there is a regulatory vacuum, and risks are constantly accumulating and exposed.

The main manifestations are as follows: First, the risk isolation mechanism is missing, and financial risks and industrial risks are cross-transmitted.

Second, some enterprises have complex control or benefit relationships and strong hidden risks.

Third, there is a lack of overall capital constraints, and some groups as a whole lack real capital that can resist risks.

Fourth, some enterprises improperly interfere in the operation of financial institutions, and use related party transactions to conceal their interests and harm the rights and interests of financial institutions and investors.

2. Penetrating supervision

In view of the complex structure of financial holding companies, it emphasizes the thorough supervision of equity and funds, accurately identifies the actual controller and the ultimate beneficiary, and prevents the real control relationship from being hidden.

Through the verification of the authenticity of the sources of funds, including the sources of funds for investment in financial holding companies and the sources of funds for investment in financial institutions, to prevent false capital injection and circulating capital injection.

3. The central bank implements supervision.

The People’s Bank of China shall supervise the financial holding companies that meet the conditions for the establishment of the Measures, and the financial supervision department shall supervise the financial institutions controlled by the financial holding companies.

Financial supervision departments supervise financial groups formed by cross-industry investment and holding of financial institutions. When the risk occurs, according to the principle of "who supervises, who is responsible", the corresponding regulatory body will take the lead in risk disposal. Strengthen supervision cooperation and information sharing among various departments to jointly guard against the risks of financial holding groups and financial groups.

4. What are the financial holding companies?

A financial holding company is defined as a limited liability company or a joint stock limited company that is established according to law, has substantial control over two or more different types of financial institutions, and only conducts equity investment management and does not directly engage in commercial business activities.

The Measures apply to financial holding companies whose actual controllers are domestic non-financial enterprises and natural persons. For financial groups formed by cross-industry investment and holding of financial institutions, the financial supervision department shall implement supervision according to the Measures and formulate specific implementation rules.

5. Financial institutions include the following six types:

Commercial banks (excluding village banks), financial leasing companies, trust companies, financial asset management companies, securities companies, fund management companies, futures companies, life insurance companies, property insurance companies, reinsurance companies, insurance asset management companies, and other financial institutions recognized by the financial management department.

6, to apply to the central bank in advance to set up a financial holding company.

Non-financial enterprises and natural persons who meet the conditions stipulated in Article 6 of the Measures shall apply to the People’s Bank of China for the establishment of a financial holding company or for the parent company of the group as a financial holding company. Among them, those who have met the requirements of Article 6 before the implementation of the Measures shall apply to the People’s Bank of China within 6 months from the date of implementation of the Measures. After the implementation of the Measures, if it intends to substantially control two or more different types of financial institutions, and it has the circumstances stipulated in Article 6 of the Measures, it shall also apply to the People’s Bank of China. Relevant implementation rules will be formulated separately.

7. These cases are not registered.

If an institution that meets the requirements for the establishment of a financial holding company fails to apply to the People’s Bank of China in accordance with the Measures, or the People’s Bank of China may, in conjunction with the relevant financial regulatory authorities, order it to make corrections. If it fails to make corrections within the time limit, it shall be ordered to transfer the equity of the financial institution it holds. Without the approval of the People’s Bank of China, a financial holding company shall not be registered as a financial holding company, and the words "financial holding", "financial control" and "financial group" shall not be used in its name.

8. What are the business scopes of financial holding companies?

The main business of a financial holding company is equity management of the financial institutions it invests in. In addition, in order to urge financial holding companies to strengthen the overall liquidity management and risk management and control of the group, so that they can provide liquidity support to the financial institutions they hold, or play a self-help role to the financial institutions they hold in case of risks, the Measures allow financial holding companies to carry out other financial businesses except equity management on the premise of obtaining approval from the People’s Bank of China.

9. Strictly isolate the financial sector from the industrial sector.Block, a financial holding company shall not engage in non-financial business.

From the perspective of based on the main business and risk prevention, financial holding companies are enterprises specializing in equity investment and management of financial institutions, and are not allowed to engage in non-financial business, so as to strictly isolate the financial sector from the industrial sector and effectively prevent cross-infection of risks.

Under the premise of strictly isolating risks, financial holding companies established by enterprise groups are allowed to invest in institutions related to financial business identified by financial management departments, but the book value of total investment shall not exceed 15% of the net assets of financial holding companies in principle.

For existing enterprises that do not meet the requirements, they are allowed to gradually adjust the proportion of investment in non-financial enterprises during the transition period. If the enterprise group as a whole is recognized as a financial holding group, its non-financial total assets shall not be higher than 15% of the total assets of the group.

10, positive list and negative list, clear financial holding company shareholders’ conditions.

Some enterprises are not strong in strength, impure in investment motives, weak in risk management and control ability and compliance management concept. They set up or become shareholders in financial holding companies only to obtain more financial licenses, or even use financial holding companies to carry out improper related party transactions and extract funds from financial institutions, which brings greater risks to financial institutions and financial holding companies.

The Measures clarify the conditions for becoming a shareholder of a financial holding company through a positive list and a negative list.

From the positive list, the major shareholders, controlling shareholders or actual controllers of financial holding companies should highlight their core business, have pure investment motives, formulate reasonable financial investment business plans, not blindly expand into the financial industry, and have perfect corporate governance structure, clear ownership structure and organizational structure, transparent shareholder and beneficial owner structure, strong management ability, effective risk management and internal control mechanism, and good financial status.

From the negative list, it is clear that the controlling shareholder of a financial holding company is prohibited from engaging in acts, and that it is not allowed to become a major shareholder, controlling shareholder or actual controller of a financial holding company. For example, it has made false investments and injected capital into financial institutions in a circulating way, and it has been responsible for the failure or major violations of financial holding companies or financial institutions.

11, strengthen the supervision of financial holding companies’ sources of funds.

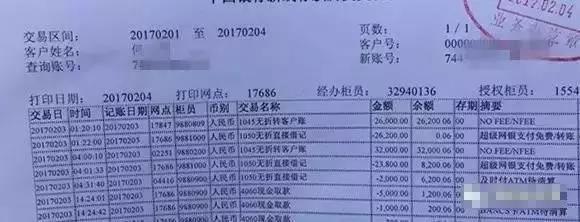

Some enterprises, through controlling financial institutions at different levels and cross-holding financial institutions, contributed with debt funds, which pushed up the overall leverage ratio and manipulated shell companies to make false capital injection and circulating capital injection, resulting in the whole group not having much real capital to resist risks.

To this end, the supervision of financial holding companies’ sources of funds emphasizes authenticity:

First, the source of funds is true and reliable. Shareholders of a financial holding company shall invest in the financial holding company with legally owned funds, and shall not invest in the financial holding company with non-owned funds such as entrusted funds, debt funds and investment funds, and shall not entrust others or accept others’ entrustment to hold the equity of the financial holding company.

Second, a financial holding company shall invest in holding financial institutions with its own legal funds, and shall not make false capital injection or circulating capital injection into financial institutions, and shall not withdraw funds from financial institutions.

The third is to carry out penetrating management on the capital compliance of financial holding companies, check the source of funds of investment holding financial holding companies upwards, and check the source of funds of investment holding financial institutions downwards.

The fourth is to establish a capital adequacy supervision system.

12. Concise, clear and penetrating ownership structure

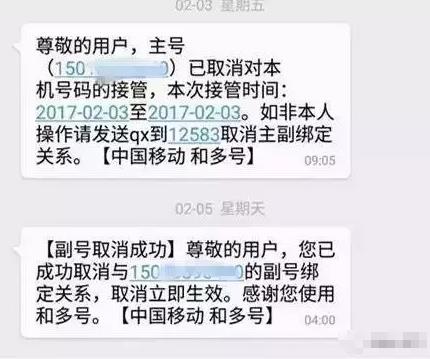

Some enterprise groups have complex ownership structure, cross-shareholding, multi-level shareholding, insufficient information disclosure, unclear beneficial owners, and nested groups within the group.

The Measures stipulate that a financial holding company should have a concise, clear and penetrable shareholding structure, which can be identified by the actual controller and the ultimate beneficiary, and the legal person level is reasonable, which is suitable for its own capital scale, operation and management ability and risk management and control level. The financial institution it controls shall not hold shares in reverse or cross-shareholding.

13, the ownership structure does not meet the need for timely rectification.

An enterprise group that should apply for the establishment of a financial holding company from the date of implementation of the Measures, but its shareholding structure does not meet the requirements, shall formulate a plan for the rectification of its shareholding, and after being approved by the financial management department, reduce the complexity of its organizational structure and simplify the legal person level during the transition period. In the process of equity transfer, if the assets involved in equity integration, transfer and transfer within an enterprise group are in compliance with the provisions of tax policies, they can enjoy corresponding preferential tax policies; Where the approval of shareholder qualification is involved, the financial management department shall apply the shareholder qualification conditions suitable for the financial holding company.

14, shall not exceed level 3.

After the implementation of the Measures, the newly-added financial holding companies, shareholders of financial holding companies, financial holding companies and financial institutions controlled by them shall not exceed level 3 in principle.

15. A financial holding company shall not abuse its substantive control rights.

A financial holding company shall not abuse its substantive control right, interfere with the independent operation of its controlled institutions, and damage the legitimate rights and interests of its controlled institutions and their related stakeholders.

16. Strengthen related party transaction management.

Strengthening the management of related party transactions is an important measure of strict risk isolation. In practice, some enterprises use the hidden ownership structure to transfer benefits through improper related party transactions, and regard financial institutions as "cash machines", which seriously damages the legitimate rights and interests of financial institutions and investors.

17. Establish a negative list of prohibited related party transactions.

First, financial holding companies should strengthen the management of related party transactions, and their intra-group transactions with controlled financial institutions, between controlled financial institutions and between controlled financial institutions and other institutions in the group, as well as related party transactions with other related parties, should be in compliance with the law.

Second, a financial holding company and its financial institutions and other related parties shall not conceal related party transactions and the true whereabouts of funds, and shall not transfer interests, evade supervision or regulatory arbitrage, damage the legitimate rights and interests of others, or damage the stability of the financial holding company through related party transactions.

Third, except for financial companies, financial institutions controlled by financial holding companies are prohibited from providing financing to financial holding companies or providing unsecured financing to other related parties. The financing or guarantee provided to related parties shall not exceed 10% of the registered capital of the financial institution or 20% of the registered capital of the related party. Financial institutions and non-financial institutions controlled by financial holding companies are prohibited from accepting the equity of financial holding companies as pledge targets, and the guarantee balance of financial holding companies outside financial holding groups shall not exceed 10% of the net assets of financial holding companies.

18. The central bank has these regulatory means and measures.

First, establish a unified supervision information platform for financial holding companies, and require financial holding companies to report and disclose information according to regulations.

The second is to establish and improve the risk assessment system of financial holding groups, and comprehensively use macro-prudential policies, financial institution ratings and other policy tools to assess the management and risk status of financial holding groups.

Third, according to the needs of performing their duties, conduct supervision talks with relevant responsible persons, conduct on-site inspections of financial holding companies, and conduct on-site inspections of financial institutions controlled by financial holding companies with the approval of the State Council when necessary, on the basis of supervision and cooperation.

Fourth, the financial holding company is required to formulate the overall recovery and disposal plan of the financial holding group.

Fifth, when a financial holding company violates the Measures or has a major risk, it will take regulatory measures such as restricting its business activities, restricting dividends or related rights, ordering it to replenish capital within a time limit, and ordering it to transfer its equity, and give it warnings, fines and other penalties.

Sixth, if it is difficult for financial holding companies to operate continuously, which will seriously endanger the financial order and harm the public interest, they should withdraw from the market according to law. Relevant implementation rules shall be formulated separately by the People’s Bank of China in conjunction with relevant departments.

19. Transition period

If an enterprise group that existed before the implementation of the Measures and meets the conditions for the establishment of a financial holding company fails to meet the regulatory requirements stipulated in the Measures in terms of the ownership structure, the proportion of institutions related to investment and financial business, and the part-time jobs of senior managers, it will be rectified within a certain period of time with the consent of the financial management department, and the specific period will be determined by the financial management department according to the actual situation of the enterprise group. At the end of the transition period, these enterprises should meet the regulatory requirements of the Measures and be accepted by the financial management department. For the increment, it will be implemented in strict accordance with the requirements of the Measures.

20. What is the impact on the financial market?

The impact on financial institutions, non-financial enterprises and financial markets is positive and the risks are controllable.

Some enterprise groups that do not meet the requirements need to carry out equity integration, but the equity transfer is carried out within the group and the actual controller has not changed, so the impact on financial institutions is limited.

In the long run, the "Measures" are conducive to controlling financial chaos, rectifying financial order, and ultimately preventing systemic financial risks.