Prepaid consumption refers to a kind of consumption mode in which consumers enjoy preferential activities of merchants in accordance with the agreed way after paying a certain fee to the operators in advance, and purchase goods or receive services in stages, that is, consumers usually encounter "card first, recharge first and then consume". In life, prepaid consumption generally exists in beauty salons, fitness, health care, laundry, retail and other industries. On the one hand, operators provide convenience for consumers, and consumers can enjoy preferential prices from merchants; On the other hand, operators can quickly increase the number of stable customers and quickly gather funds.

In recent years, prepaid consumer disputes have gradually increased and become a hot spot of consumer disputes. In 2018, the province’s Consumer Protection Committee system accepted a total of 130,505 complaints, including 16,976 complaints about prepaid consumption, accounting for 13.01% of the total complaints. Jiangsu(Province)In 2018, the Provincial Consumer Protection Committee supported a total of 5 consumer lawsuits, all of which were prepaid consumer disputes, accounting for 100%.Some operators have hidden traps when providing goods or services, and the way of paying first and then consuming often puts consumers in a passive position, and it is impossible to predict the consistency and consistency of providing standard services. Even some operators run away after receiving the advance payment, which leads to mass incidents and affects social stability.

The Regulations on the Protection of Consumers’ Rights and Interests in Jiangsu Province, which came into effect on July 1, 2017, clearly stipulates the scope of prepaid cards and the setting of time limit, and gives consumers the right to regret on the 15th. However, over the past year or so, disputes over prepaid cards still occur frequently.

In order to protect the legitimate rights and interests of consumers, such as the right to know, the right to property safety, the right to claim compensation, and promote the healthy development of prepaid consumption mode, Jiangsu Consumer Protection Committee conducted a survey on prepaid consumption in Jiangsu Province around the theme of "Credit makes consumption more secure", deeply understood the current situation of prepaid consumption, analyzed the crux of the problem and put forward reasonable suggestions.

First, the basic situation of investigation work

(1) Time of investigation

February 2019 — Mar.

(II) Respondents

The prepaid cards mentioned in this survey are all single-purpose prepaid cards, which are prepaid vouchers for operators to provide goods or services in advance, including physical cards with magnetic stripe cards, chip cards and paper coupons as carriers and virtual cards with passwords, serial codes, graphics and biometric information as carriers. Divided into registered cards and bearer cards.

(3) Survey method and sample size

This survey adopts the combination of online questionnaire survey and offline observation survey, and obtains a total of 17,546 valid samples.

Online: With the help of the official WeChat platform of Jiangsu Consumer Protection Committee "Jiangsu Consumer Protection Committee" and Litchi News,WeChat Official AccountOnline media such as "xici" homepage conducted a questionnaire survey on prepaid card consumption. A total of 17,476 valid samples were obtained from the online questionnaire survey.

Offline: An investigation team composed of volunteers made an investigation on 70 samples in Jiangsu Province, covering six cities in Jiangsu Province, including Nanjing, Changzhou, Nantong, Yancheng, Yangzhou and Xuzhou, and involving six industries, including beauty salons, fitness, health care, comprehensive retail, education and training, and laundry, where prepaid consumer disputes are frequent. A total of 70 valid samples were obtained from offline field experience, including 61 registered cards and 9 unregistered cards.

Second, analysis of the survey results of prepaid card processing

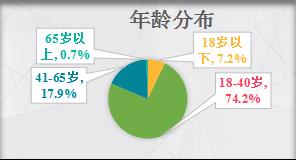

(1) Investigation on the basic situation of consumers: 85% of consumers have done prepaid cards, and the most involved fields are beauty salons, comprehensive retail and fitness industries.The online questionnaire survey shows that the proportion of male and female consumers participating in the survey is 60.8% and 39.2% respectively. 7.2% of consumers are under 18, 74.2% are between 18 and 40 years old, 17.9% are between 41 and 65 years old, and only 0.7% of consumers are over 65 years old. From the perspective of age distribution, the consumer groups are mainly young and middle-aged.

Among online participants, 70.2% of consumers have handled it, 14.6% of consumers often handle it, 15.2% of consumers have never handled it, and nearly 85% of consumers have handled prepaid cards.

Among them, 41.3% of consumers apply for a card because of the strong preferential treatment of merchants, 37.8% think it is convenient to settle accounts, 13% are embarrassed to refuse the promotion of merchants, and 7.8% of consumers choose to apply for a card for other reasons.

From the point of view of the industries selected to handle the card, beauty salons (including beauty, manicure and haircut) and comprehensive retail (including department stores, supermarkets, grocery stores and convenience stores) are the most, followed by fitness, catering and education and training.

(two) in the field experience, more than half of the operators’ advance payment exceeds the limit.

According to the Regulations on the Protection of Consumers’ Rights and Interests in Jiangsu Province, if an operator issues a single-purpose prepaid card (including other advance receipts), the limit of a single registered card shall not exceed 5,000 yuan, and the limit of a single bearer card shall not exceed 1,000 yuan. Among them, individual industrial and commercial households need to issue single-use prepaid cards, and the single-page limit shall not exceed 1,000 yuan.

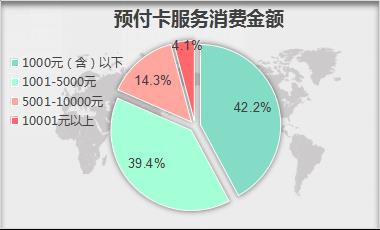

However, the results of this survey show that many prepaid cards issued by operators have exceeded the limit. According to the online questionnaire survey data, after July 1, 2017, 42.2% of consumers said that they had paid less than 1000 yuan, 39.4% had paid 1,000-5,000 yuan, 14.3% had paid 5,001-10,000 yuan, and 4.1% had paid more than 10,000 yuan. 18.5% of consumers spend more than 5,000 yuan on prepaid card services.

Among the prepaid cards with a single amount exceeding that of 1000 yuan, 74.1% of consumers said that the prepaid card was a registered card, and 25.9% of consumers were unregistered cards. That is to say, 25.9% of the consumption of bearer cards has exceeded the limit.

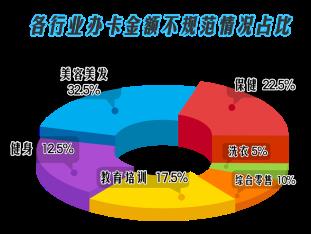

In the off-line physical survey, 57.1% of the samples have the situation that the amount of advance payment exceeds the limit, among which the excess situation in beauty salons, health care and education and training industries is more serious, accounting for 32.5%, 22.5% and 17.5% respectively.

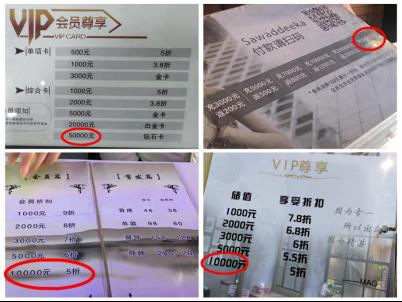

The advance payment of some registered card samples far exceeds the legal limit of 5,000 yuan, such as Nantong Yongqi Beauty Salon.A shopNanjing Taihe sealcertainThe store leaflet page says that the maximum recharge amount is 50,000 yuan, in Wang Yu, Changzhou.certainIn the introduction of the stored-value card hanging behind the cashier, the maximum amount is 60,000 yuan. In the survey, some companies did not directly display the amount of advance payment through leaflets and other forms, but they learned that there was also excess by asking the staff, and even some businesses said that "the recharge amount is not capped".

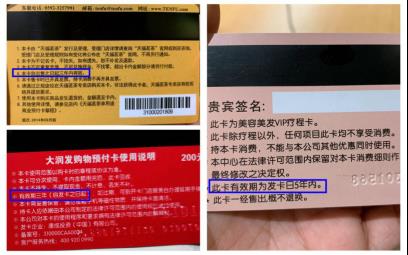

Example diagram of excessive advance payment amount of some registered cards

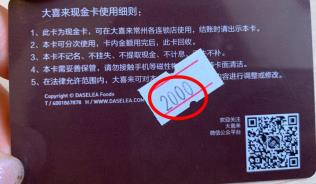

44.4% of the bearer card samples are in excess, among which Changzhou is happy.certainThe highest amount of cash card advertised by the store is 500 yuan. However, when the experiencer asks if it is ok to handle a bearer card with a face value of 2000 yuan, the staff can, but they say that there is no cash card, so they need to go to the Finance Department to make a card with this face value and deliver it the next day after receiving cash in advance.

Example diagram of excessive advance payment amount of bearer card

(3) When handling prepaid cards, most operators will not take the initiative to sign consumption contracts with consumers.

According to the Regulations on the Protection of Consumers’ Rights and Interests in Jiangsu Province, when an operator provides goods or services in the form of advance payment, it shall clearly agree with consumers on the quantity and quality, price or expenses, time limit and method of performance, safety precautions and risk warning, after-sales service, civil liability and other contents.

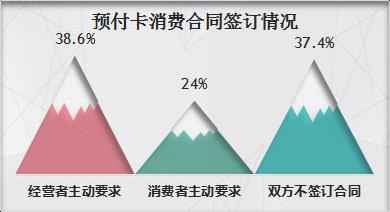

In the online questionnaire survey, only 38.6% of the operators signed the consumption contract voluntarily when handling prepaid cards for consumers, 24% of the consumers asked to sign the contract voluntarily, and 37.4% did not sign the contract.

In the field survey, when handling prepaid cards, only 20% of the samples signed contracts at the initiative of the operators and consumers, and 30% of the experience samples did not sign formal contracts, but registered the personal information of consumers.remain50% of the experience samples have not signed a contract.Agreement, also did not register consumer information..

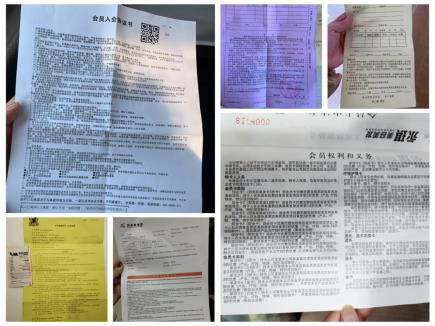

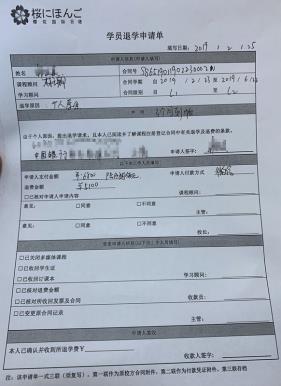

Sample diagram of some contracts

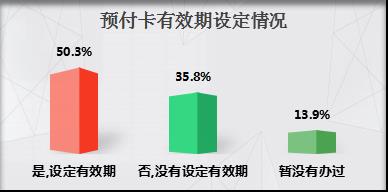

(4) The validity period of some prepaid cards is set.

According to the Regulations on the Protection of Consumer Rights and Interests in Jiangsu Province, the validity period of prepaid cards shall not be set.

In the online questionnaire survey, 50.3% of consumers have set the expiration date for prepaid cards, while 35.8% have not set the expiration date.

According to the offline survey results, 27.1% of prepaid cards have a valid period, 60% of prepaid cards have no valid period, and 12.9% of them have a valid period, but the merchants verbally promise that consumers will not have a valid period when using them.

Sample Diagram of Setting Validity Period for Some Samples

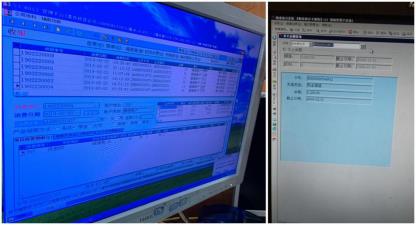

(5) No one in the survey publicized the total amount and usage of prepaid cards.

In the online questionnaire survey, 63.5% of consumers said that the operators did not regularly publicize the total amount and usage of prepaid cards in their business premises, and 36.5% of consumers said that the operators regularly publicized the total amount and usage of prepaid cards in their business premises.

However, in the offline investigation, all the samples did not disclose the total amount and use of prepaid cards in the business premises. At the request of the inspectors, some merchants’ computer background systems can check the funds of prepaid cards.

Sample Diagram of Backstage Inquiry of Prepaid Card Funds for Some Samples

In addition, the field experience survey results show that 50% of the samples have the problem that the business license is not publicized on the wall; After the prepaid card is recharged, 14.3% of the merchants have no recharge credentials such as invoices or receipts.;After spending the card, 58.6% of the samples have paper or electronic receipts with the balance indicated, 5.7% have paper or electronic receipts without the balance indicated, and 35.7% have no consumption vouchers.

Third, analysis of the investigation results of prepaid card withdrawal

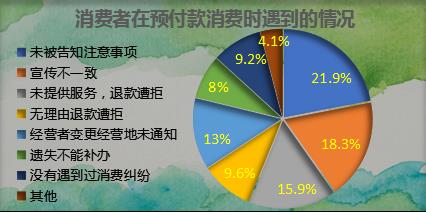

In 2018, the complaint data of prepaid consumption accepted by the Jiangsu Consumer Protection Committee system showed that the top three complaints about prepaid cards were that consumers were dissatisfied and asked to return their cards, businesses ran away, and consumers returned their cards for personal reasons.

(1) Consumers’ requests for card refund are frequently rejected.The results of online questionnaire survey show that 15.9% of consumers were rejected because the merchants did not provide goods or services as agreed and asked the merchants to refund; 13% of consumers were rejected because the merchants closed down, closed down or changed their business premises and asked for a refund; 9.6% of consumers’ requests for unreasonable refund within 15 days of card application were rejected.

In addition, in the process of prepaid card consumption, 21.9% consumers were not informed of the precautions when they applied for the card, 18.3% thought that the goods or services were inconsistent with the publicity, and 9.2% did not encounter any consumption disputes; 8% cannot be reissued because the card is lost.

In the field experience survey, 57.1% of the merchantsWhen the experiencer asks for a refund, he saidDo not agree to refund,butamongpartMerchants are observing personnel "arguing" or even "arguing fiercely"barge"After the consent.. finallyThere are still 25.7% businesses insisting.No refund will be given.Only 42.9% of the merchants agreed to refund after the inspectors first proposed the refund. In addition, three of the non-refundable samples were bearer cards, accounting for 33.3% of all bearer card samples in this survey.

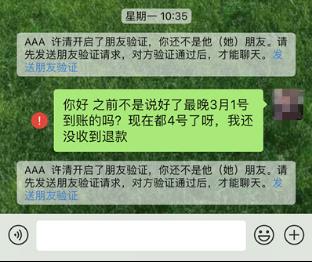

(2) The merchant agrees to return the card but fails to refund the money according to the agreed time or the refund process takes too long.Although some merchants promised a refund and promised in writing the latest time for the refund to arrive, they did not honor their promises on time. For example, a store in Nanjing Xiaomeihui promised a refund on March 1 at the latest, but when the inspector contacted the other store manager on the 4th, he found that the other party had deleted the WeChat friend. After calling the customer service number, the customer service said that there was no mobile phone number of the store manager and the store manager could not be contacted. finallyAfter many negotiations,The other party completed the refund on March 8.

It takes a long time for some merchants to receive the rest of the money after returning their cards. According to the investigation, it is a regular time to receive the money within one week, and a little longer is about one month, but Changzhou Sakura JapaneseTraining institutionsIt means that the card refund process takes 3 months.

(three) fees are non-refundable,Shall not terminate the contract… … It is difficult to withdraw the card from the "overlord clause" in the fitness industry

In the sample of the fitness industry in this survey, 90% of the merchants said that they could not return their cards, and suggested that the inspectors transfer the cards. But each family needs 300— 500 yuan’s card transfer fee varies, including 480 yuan (monthly card) for the store of Nanjing Yingpaisi National Fitness Center, but 400 yuan is needed for the card transfer fee.

The common types of overlord clauses include: (1) agreeing that the final interpretation right belongs to the merchants, such as a store in Nanjing Branch Laundry, a store in Yancheng Nasdaq English, a store in Yangzhou Meg Image Design Salon and Changzhou Muqing Health Club; (2) It is agreed that the prepaid card will not enjoy other benefits at the same time, such as a store in Wang Yu, Nantong Huaxia Liangzi, Yangzhou UCC International Laundry, Xuzhou Lanxi Modeling, etc. (3) Prepaid cards are non-refundable, such as a store in Yancheng Pandora Modeling, a store in Xuzhou Pengzu Driving, a store in Nanjing Taihe Xi, a store in Yancheng Hanbang Fitness, etc. (4) If the prepaid card is lost, it will not be replenished or the card replacement procedure is complicated, such as a store in king of the children, Changzhou Jieji Fruit Store, Yancheng Golden Eagle International, Changzhou Daxilai Store, etc.

At present, there is a general overlord clause in prepaid consumer contracts, mainly because these contracts are unilaterally drawn up standard contracts, and consumers can only express their full agreement or disagreement, so there is no room for negotiation on the terms. According to the provisions of Article 40 of the Contract Law, if the party providing the format clause exempts its liability, aggravates the other party’s liability or excludes the other party’s main rights, the clause is invalid. Therefore, clauses such as "the final interpretation right belongs to the merchant", "the prepaid card is non-refundable, lost and not replenished" and "the contract cannot be terminated" are of course invalid, even if the consumer agrees, they will not be effective.

(fourMerchants don’t refund money when they run, and consumers have no way to refund their cards.

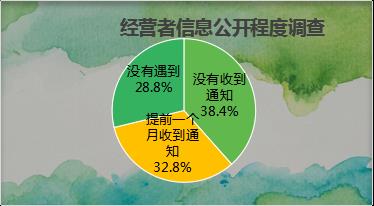

In the questionnaire "Did you receive the operator’s notice one month in advance when the operator closed down, closed down or changed its business premises", 38.4% of consumers did not receive the notice, 32.8% received the notice one month in advance, and 28.8% did not encounter the operator’s closure, closed down or changed its business premises.

According to the complaint data of prepaid consumption accepted by the Jiangsu Consumer Protection Committee system in 2018,Complaints received due to "merchants running away"5417 cases, accounting for the annual prepaid consumer complaints.total capacity32%.In this physical investigation, no sample ran away, but the sample of a store in Nanjing Jaeger-LeCoultre was changed to Platinum Meiye at the time of investigation, and the other party said that it had changed its boss. The original Jaeger-LeCoultre membership card could be recycled after a certain reduction rate, but the specific reduction rate was not provided by the other party.

Although some businesses have not terminated their services, they frequently change their business entities, which seriously affects consumer confidence. In 2016, Ms. Miao applied for a 50,000-yuan prepaid card at Kafan Yincheng Dongyuan Store. In 2018, the store was transferred to Jaeger-LeCoultre, which is still a beauty salon. Ms. Miao contacted Kafan Head Office and the store manager, and the other party said that if the card needs to be returned, the 30,000-yuan spent item will be deducted according to the original price, and the original price of the 30,000-yuan spent item has exceeded 50,000 yuan. The operator said that the card can continue to be used in the new store, so Ms However, the store was renamed Amy soon. In February this year, the store was under renovation and its name was changed. After each store name change, when Ms. Miao asks for a card transfer, the newly opened store will ask for a recharge before continuing to enjoy the original discount. The same address is a beauty salon,butDecoration and store nameFrequent replacementThe prepaid card purchased by consumers will be recharged repeatedly.Otherwise, you can’t activate the helplessness..

Fourth, consumers suggest improving laws and regulations

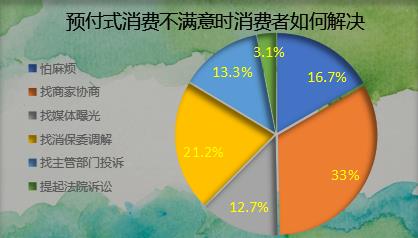

The results of online questionnaire survey show that if consumers are not satisfied with the consumption of prepaid services, 33% of them will seek the coordination of merchants, 21.2% will seek the mediation of Consumer Protection Committee, 16.7% will be afraid of trouble, 13.3% will complain to the competent authorities, 12.7% will seek media exposure, and 3.1% will file a court lawsuit.

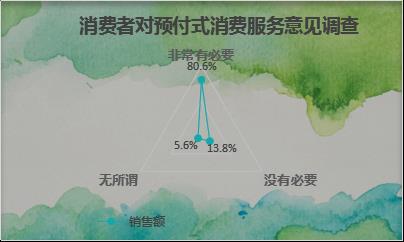

In the online questionnaire survey, 80.6% of consumers think it is very necessary to strengthen the management of prepaid card issuance, fund supervision and risk monitoring by improving laws and regulations, 13.8% of consumers think it is unnecessary, and 5.6% think it doesn’t matter. This result reflects that more than 80% of consumers hope to strengthen the market supervision of prepaid card consumption through the improvement of laws and regulations.

Consumer protection Committee suggested

The lack of laws and administrative regulations on single-use prepaid cards in China is far from solving the practical contradictions caused by single-use prepaid cards. At present, the management of single-use prepaid cards in Jiangsu is mainly based on the Administrative Measures for Single-use Commercial Prepaid Cards (Trial) issued by the Ministry of Commerce in 2012 (hereinafter referred to as the Administrative Measures) and the Jiangsu Consumer Protection Regulations (hereinafter referred to as the Consumer Protection Regulations) which came into effect on July 1, 2017.

In terms of supervision of prepaid card issuing enterprises, Article 64 of the Consumer Protection Regulations stipulates that if an operator issues a prepaid card exceeding the prescribed limit in violation of the second paragraph of Article 27 of these regulations, or fails to fulfill the refund obligation in violation of the second and third paragraphs of Article 28, the commercial department shall order it to make corrections within a time limit; If no correction is made within the time limit, a fine of not less than ten thousand yuan but not more than thirty thousand yuan shall be imposed. However, Article 2 of the Administrative Measures stipulates that its applicable subject is an enterprise legal person engaged in retail, accommodation and catering, and residential service. This will lead to more concentrated complaints about prepaid card consumption disputes and more individuals running away.industry and commerceSupervision of householdsIs still a big problem.

(1)Fill the lawRegulatoryblind zone.It is still difficult to legislate at the national level. In view of the persistent problems of single-use prepaid card operators running away and lack of supervision of funds, it is suggested to introduce local regulations and legislation for single-use prepaid card management in Jiangsu Province as soon as possible with reference to the practice of Shanghai.Focus on solving the following aspects:

Incorporate individual industrial and commercial households into the scope of supervision. nowAdministrative measuresYes, there are a lot oflaunchIndividuals with prepaid business activitiesIndustrial and commercial householdsThere is no restriction,As long as a set of so-called membership management system is formulated, merchants can recruit members and absorb funds. The conditions for issuing prepaid cards, the amount of funds received in advance, the issuance and redemption of consumer cards, and the preservation of transaction records are all their own decisions. It is suggested to learn from the supervision experience of issuing prepaid cards by enterprise legal persons, bring the prepaid card business activities of individual industrial and commercial households into the scope of administrative supervision, and clarify the qualifications of issuers, access conditions, filing management and capital risk monitoring. The competent authorities of the industry should determine the supervision objects based on the business behavior of market entities, rather than distinguishing the attributes of businesses.The Regulations of Shanghai Municipality on the Management of Single-use Prepaid Consumer Cards was formally implemented on January 1, 2019, in which Article 2 included the business activities of single-use prepaid consumer cards and their supervision and management within the administrative area of Shanghai into the scope of the regulations.

Clarify the administrative supervision of various industriesdepartment.The issuance of single-use prepaid cards involves many industries, especially after a large number of self-employed individuals are brought into supervision.In order to avoid unclear responsibilities between administrative departments, it should be further clarified.Business, education, tourism culture, etc.The subject and scope of industry supervision of single-use prepaid cardsAnd responsibilities.At the same time,Market supervision, taxation, public security, People’s Bank of China, China Banking Regulatory Commission and other departments to assist.Supervision, strengthen the joint.renovate, the implementation of the whole process supervision of its business access, trading behavior, business behavior, etc.. The Consumer Protection Committee (Consumers Association) and the administrative organ should give full play to their respective advantages. The consumer protection system should strengthen the publicity and education of consumers and consumer guide, and pay attention to the docking of complaints and referrals. The administrative organ should establish a list of serious untrustworthy subjects, aiming at major typical cases found.Business departmentYing LianMarket supervision and other departmentsCarry out joint rectification, shock the industry and purify the market,Strengthen the standardization of card issuing operatorschangemanage, increase the intensity of illegal punishment.

Establish marginsystemOr a third-party payment management system.Merchants issue a large number of prepaid cards and reserve a large amount of funds in a short time. Once it appears later,If the funds are used for other purposes, the investment fails or the funds cannot be withdrawn in time, it will lead to a refund redemption crisis involving many consumers. suggestionIntroduce banks as the third-party supervision of prepaid card funds and establish a deposit system.Restrain merchants and improve the "single insurance" mode of prepaid card funds only relying on merchants’ own credit.. The deposit is the same as the amount received in advanceshould doMaintain a certain proportion, and the margin account shall not be misappropriated.Once it appears,Consumer rights and interests are damagedSituation, butPay compensation in advance from this account.At the same time, you canImplement the payment management system of third-party payment, such as Alipay, WeChat, bank escrow, etc., to prevent operators from suddenly rolling up money and fleeing.Consumer property suffers losses,Safeguard consumers’ right to property safetyAnd the right of claim.

(2)Prepaid consumption concentration industrybuildModel text of contract.

The survey found that most prepaid consumers have no formal contracts and do not issue invoices.Provide a card or only keep the mobile phone number of the consumer, even if the contract is signed, it will stipulate the overlord clauses such as "our store has the right to modify and terminate the use right of the consumer card" or "the prepaid service fee for applying for card refund will not be refunded". Even if it recharges tens of thousands of dollars, even the operators who say "the top is not capped" do not have a complete contract to protect consumers’ legitimate rights and interests such as the right to know, the right to safety, the right to fair trade and the right to claim compensation.

The Provincial Consumer Protection Committee suggested to establish a model contract text for industries with concentrated prepaid consumption. In the model contract text, the merchants are required to list the performance period, scope of use, detailed address of the merchants, the amount and payment method of the prepaid consumer card, the way of performance guarantee responsibility, and the liability for breach of contract. explicitIf the consumer card is terminated or changed due to the reasons of the merchant, the consent of the consumer shall be obtained. If the consumer disagrees, the merchant shall refund the balance of the card in full according to the expenses paid by the consumer when actually purchasing, after deducting the consumption after enjoying the preferential margin.Aiming at the problem of overlord clause, it can be excluded by enumeration.

In view of the businesses found in this survey that have many problems involving overlord clauses and refuse to apply for prepaid card refunds without reason or obstacles, the Provincial Consumer Protection Committee will ask the operators to rectify within a time limit by means of interviews, etc., and those that are illegal will be handed over to relevant departments.

Consumer tips

Can impulse consumption be refunded?

In June 2018, Ms. Ren spent 6,000 yuan under the strong marketing of a beauty and body business.

Yuan purchaseoneA membership card. After returning home, Ms. Ren regretted it and asked the merchant for a refund of the card, which was decisively rejected by the merchant.

Case analysis: This case is a typical dispute caused by impulsive consumption. According to Article 28 of the Regulations on the Protection of Consumers’ Rights and Interests in Jiangsu Province: "If an operator provides goods or services by issuing a single-use prepaid card, the consumer has the right to ask for a refund within 15 days from the date of payment without reason, and the operator can deduct the reasonable expenses it has incurred for providing goods or services." This clause clearly gives the consumer the right to return the card for 15 days without reason. Ms. Ren enjoys a 15-day cooling-off period when purchasing a prepaid card, and the merchant should make a refund request within the cooling-off period.

Consumer Tips: Consumers must be rational before choosing a card, and handle it rationally according to their own needs. Don’t be tempted by the sales promotion of merchants, try to choose a prepaid card with a small amount and use it as soon as possible.

When the swimming card expires, do you have to pay before activating it?

Yu Xiansheng handled a swimming card in 2017, with a balance of more than 1,000 yuan. In July, 2018, Yu Xiansheng was told that the card had expired, and if he wanted to continue to use it, he needed to recharge it again.

Case analysis: This case is a typical prepaid consumption dispute caused by setting the validity period. Paragraph 2 of Article 27 of the Regulations on the Protection of Consumer Rights and Interests in Jiangsu Province stipulates: "… … Prepaid cards may not have a valid period. " Article 19 of the Measures for the Administration of Single-use Commercial Prepaid Cards stipulates: "A registered card shall not have a valid period; The validity period of bearer cards shall not be less than 3 years. Card issuing enterprises or card selling enterprises should provide supporting services such as activation and card replacement for bearer cards with a balance of funds beyond the validity period. " Therefore, when there is still a balance in the card, it is illegal for the operator to refuse to use it on the grounds of expiration, which is suspected of unjust enrichment.

Consumer Tips: According to Consumer Protection Regulations, the validity period of prepaid cards may not be set. Even if the validity period of bearer cards is set according to Administrative Measures, operators are obliged to provide services such as extension and activation for bearer prepaid cards of consumers to ensure their normal use.

Can I refund the "No Termination of Contract"?

In September 2017, Ms. Liu registered 60 private fitness classes for her children in a center in Nanjing, and paid 15,840 yuan after the discount. After six classes, I want to cancel the contract and return the card because my child is busy with school work. However, the center refused to apply for a refund for consumers on the grounds that the agreement stipulated that "the contract shall not be terminated".

Case analysis: According to Article 40 of China’s Contract Law: "If the party providing the standard clause exempts its responsibility, aggravates the other party’s responsibility and excludes the other party’s main rights, the clause is invalid." Article 26 of China’s Consumer Protection Law also stipulates: "… … Operators shall not make unfair and unreasonable provisions to consumers, such as excluding or restricting consumers’ rights, lightening or exempting operators’ responsibilities, and aggravating consumers’ responsibilities, by means of format clauses, notices, life notices, store notices, etc. … … Format clauses, notices, statements, store notices, etc. contain the contents listed in the preceding paragraph, and their contents are invalid. " The fitness center deprives consumers of the right to terminate the contract in the form of standard clauses and overlord clauses, which obviously infringes on consumers’ fair trade rights and should be considered invalid.

Consumer tip: "No termination of the contract" is the overlord clause, and consumers still have the right to terminate the contract. However, in the case of consumer default, the operator will charge a certain amount of liquidated damages and refund the card for the consumer.

What if the merchant runs away?

Since February 2018, consumers have continuously reported that a restaurant located in Sucheng District, Suqian City closed down without notifying the relevant cardholders to deal with the aftermath, resulting in consumers’ stored-value cards being unable to continue to be used, and consumers have no way to refund.

Case analysis: The business operator in this case can’t fulfill the obligation of providing catering services as agreed, which infringes on the legitimate rights and interests of consumers, such as fair trading rights. According to Article 53 of China’s Consumer Protection Law, "If the business operator provides goods or services in advance, it shall provide them as agreed. If it is not provided in accordance with the agreement, it shall fulfill the agreement or refund the advance payment according to the requirements of the consumer. " The business operator shall refund the remaining money that has not been consumed according to the requirements of consumers.

Consumer tips: when consumers find that businesses violate laws and regulations or have abnormal business conditions, they should consult or report to relevant departments in time; If the business suddenly closes down and cannot be contacted, and fraud is involved, it should be reported to the public security department in time.