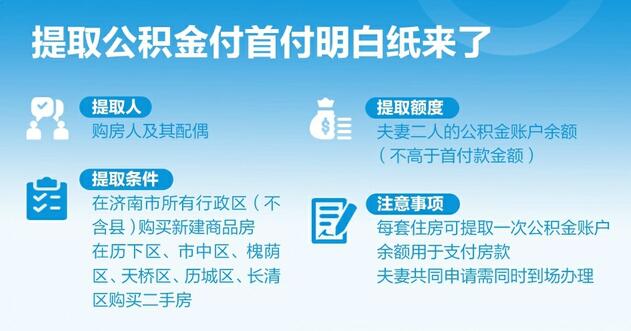

On September 15th, Jinan Housing Provident Fund Center issued a new policy. Employees who paid the housing provident fund in the headquarters of Jinan Housing Provident Fund Center can buy new commercial housing or stock housing in the administrative area of Jinan, and my spouse and I can apply for withdrawing the housing provident fund to pay the down payment. The policy will take effect immediately.

Optimistic about the applicable area: the down payment for second-hand houses is limited to the main city.

The policy stipulates that new commercial housing should be purchased in Lixia District, Shizhong District, Huaiyin District, tianqiao district, Licheng District, Changqing District, Zhangqiu District, Jiyang District, Laiwu District and Gangcheng District of this city; Employees and their spouses who have paid in the headquarters to buy existing housing in Lixia District, Shizhong District, Huaiyin District, tianqiao district City, Licheng District and Changqing District of this Municipality may apply for transferring the balance of individual housing provident fund account to the supervision account to pay the down payment for house purchase. Employees whose purchased houses are not in the above-mentioned areas or who have not applied for transferring the balance of individual housing provident fund account to the supervision account to pay the down payment can apply for withdrawal of individual housing provident fund after the online signing of new commercial housing or the transfer of stock housing transactions, and the withdrawal amount shall not exceed the down payment of purchased houses.

Look at the handling conditions: the process of buying houses with different properties is different.

In order to ensure the safety of funds, the application for the down payment business of provident fund needs to be handled at the scene with the identity certificate, and both husband and wife should apply at the same time.

Among them, for the purchase of newly-built pre-sale commercial housing, the purchaser will sign the Letter of Commitment on Authorization for Withdrawing Housing Provident Fund to Pay the Down Payment of House Purchase at the service hall window of the Provident Fund Center with the Confirmation Sheet of Jinan Commercial Housing Pre-sale Fund Deposit Information (provided by real estate development enterprises). If the spouse of the purchaser applies, it is necessary to provide proof of marriage relationship to apply at the scene. Applicants are required to complete the online signing formalities with the Housing Provident Fund Payment Certificate to the real estate development enterprise within 3 working days. After obtaining the online signing information, the provident fund center will transfer the withdrawal amount to the special account for the supervision of pre-sale funds of commercial housing in this project.

When purchasing a newly-built commodity house for sale, the purchaser and the real estate development enterprise shall sign an online contract to Jinan Real Estate Transaction and Leasing Service Center (hereinafter referred to as the "Real Estate Transaction Center") to handle the fund supervision business, and sign the "Authorization Commitment for Withdrawing Housing Provident Fund to Pay the Down Payment for House Purchase" on the spot. If the spouse of the purchaser applies, it is necessary to provide proof of marriage relationship to apply at the scene. The real estate transaction center will push the relevant information of the applicant to the provident fund center. The Provident Fund Center shall review and approve the withdrawal qualification and withdrawal amount within 1 working day after receiving the push information. If there is no mistake in the review, the withdrawal amount shall be immediately transferred to the special account for the supervision of the stock room funds of the real estate trading center. Within 1 working day after the withdrawal amount is deposited in the supervision account, the real estate trading center completes the transfer of funds to the real estate development enterprise.

For the purchase of stock housing, both parties to the transaction go to the real estate trading center to handle online signing and fund supervision business, and sign the "Commitment Letter of Authorization for Withdrawing Housing Provident Fund to Pay the Down Payment for House Purchase" on the spot. If the spouse of the purchaser applies, it is necessary to provide proof of marriage relationship to apply at the scene. The real estate transaction center will push the relevant information of the applicant to the provident fund center. The Provident Fund Center shall review and approve the withdrawal qualification and withdrawal amount within 1 working day after receiving the push information. If there is no mistake in the review, the withdrawal amount shall be immediately transferred to the special account for the supervision of the stock room funds of the real estate trading center. Within 1 working day after the parties to the transaction complete the registration of real estate, the real estate trading center completes the transfer of funds to the seller.

Optimistic about restrictive conditions: personal loan rate ≥ Suspend extraction at 90%

According to the policy, in order to prevent the liquidity risk of housing provident fund, the down payment business of housing provident fund is dynamically managed according to the real-time situation of the personal housing loan rate of the headquarters of the provident fund center (hereinafter referred to as "personal loan rate", which refers to the ratio of the balance of personal housing provident fund loans to the balance of housing provident fund deposits), and the personal loan rate is regularly published on the official website of Jinan Housing Provident Fund. When the personal loan rate is below 90%, the business specified in these rules will be accepted normally; When the personal loan rate is higher than 90% (inclusive), the business specified in these rules will be suspended.

The policy stipulates that each house can withdraw the balance of the housing provident fund account once to pay the down payment for buying a house. Eligible buyers and their spouses shall jointly submit an application at one time, and the total withdrawal amount shall not exceed the down payment amount stipulated in the online signing contract. If the withdrawal amount is less than the down payment amount stipulated in the online signing contract, the remaining part shall be filled by the buyers themselves.

For employees who have paid the down payment for the provident fund, they can apply for housing provident fund loans if they meet the conditions for housing provident fund loans. The down payment amount of provident fund can be combined with the balance of individual housing provident fund account to calculate the amount of provident fund loan. Employees who have paid the down payment from provident fund can no longer apply for withdrawal of housing provident fund according to the conditions of purchasing this property.

For the cancellation or change of the online signing contract, the down payment paid by the purchaser’s provident fund shall be returned to the Jinan Housing Provident Fund Center account and re-included in the individual housing provident fund account. (Jinan Times New Yellow River Client Reporter Luo Xiaofei)

Memorabilia of Jinan Provident Fund Policy Adjustment in Recent 2 Years

On May 23, 2022, the amount of public loan for the first home was increased.

The maximum loan amount for a family with one person contributing to the provident fund is raised from 300,000 yuan to 350,000 yuan.

The maximum loan amount for families with two or more people contributing to the provident fund will be raised from 600,000 yuan to 700,000 yuan.

On May 24, 2022, the "house recognition and loan recognition" was cancelled.

The first suite identification standard was changed from no housing and no housing loan record in this city to no housing in this city.

The down payment ratio of public loans for the first home of non-local registered families was adjusted from 60% to 30%.

On August 15, 2022, the down payment ratio of the second home public loan was lowered.

The minimum down payment ratio is adjusted from 60% to 40%, which is consistent with commercial loans.

On October 1, 2022, the interest rate of the first home public loan was lowered.

The interest rate of the first home public loan was lowered by 0.15 percentage points, and the interest rates for less than 5 years (including 5 years) and more than 5 years were adjusted to 2.6% and 3.1% respectively.

The interest rate of the second home public loan remains unchanged, and the interest rates for less than 5 years (including 5 years) and more than 5 years are not less than 3.025% and 3.575% respectively.

On November 12, 2022, the amount of public loan for the first home was increased again.

The maximum loan amount for a family with one person contributing to the provident fund is raised from 350,000 yuan to 500,000 yuan.

The maximum loan amount for families with two or more people contributing to the provident fund will be raised from 700,000 yuan to 800,000 yuan.

On January 10, 2023, the amount of public loans for families with many children increased.

When a two-child family buys the first suite, one person can borrow up to 600,000 yuan from the provident fund, and two or more people can borrow up to 900,000 yuan from the provident fund.

When a family with three children or more buys the first suite, one person can borrow up to 600,000 yuan from the provident fund, and two or more people can borrow up to 1 million yuan from the provident fund.

On July 6, 2023, the amount of public loans for college graduates increased.

College graduates leave for employment and start businesses, pay the housing provident fund for three months before the end of the graduation year, and buy the first suite within five years of graduation. The first public loan amount can be increased by up to 200,000 yuan on the basis of the actual loanable amount.

(Zheng Chuqiao finishing)