In terms of scale, Gree Electric lags behind Midea Group in air conditioning, small household appliances and diversified businesses, with a total revenue difference of 98 billion yuan in the first half of 2023. However, judging from many data, Gree still has its own advantages, such as abundant cash on the account and high gross profit margin of air-conditioning business.

author |Lin Xia Xi

source | City boundary

Revenue reached a new high in the first half of the year, and net profit did not return to a high point.

If one sentence is used to describe the semi-annual report of 2023 released by Gree Electric on the last day of August, it is that "all aspects are recovering, but many data are hidden".

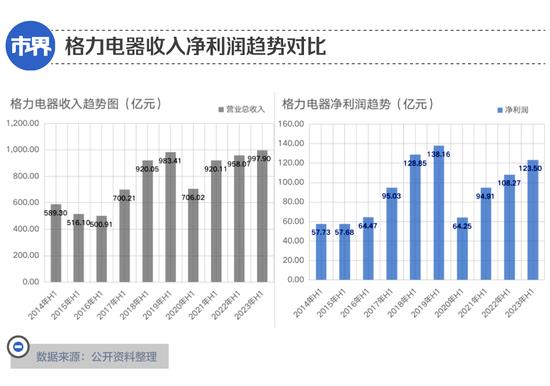

Let’s look at the overall revenue and net profit performance-99.79 billion yuan and 12.35 billion yuan in the first half of the year, respectively. The former hit a record high, but the year-on-year growth rate was small, only 4.16%, while the latter maintained a growth rate of 14%, but it still did not reach the level of 2018 and 2019.

Such growth has not kept pace with the market.

Under the influence of El Ni? o phenomenon, there was a rare high temperature in the first half of 2023. Stimulated by this, although the real estate industry remained sluggish, the sales and retail sales of domestic household air conditioners increased by 12.72% and 16% respectively, which was much higher than Gree’s overall income and air conditioning income.

On a larger scale, Gree Electric, which lags behind the market, is also gradually falling behind in the world. According to the latest data, the threshold for entering the Fortune 500 in 2023 is 225.165 billion yuan, while Gree’s annual income in 2022 is 190.151 billion yuan, and there is still a certain gap. From 2019 to 2022, Gree Electric’s ranking in the Fortune 500 has also dropped from 414 to 487.

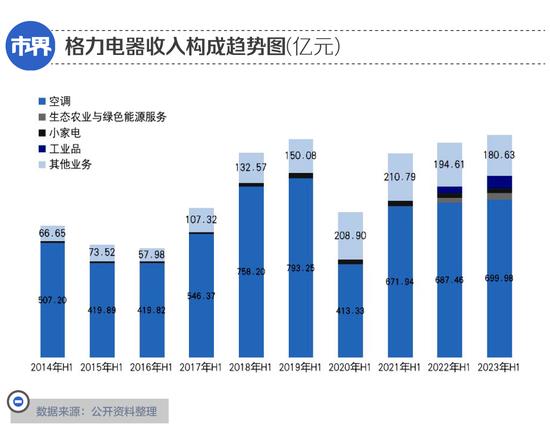

In terms of revenue composition, Gree Electric’s revenue of 99.79 billion yuan in the first half of this year accounted for more than 1% of the business, including air-conditioning business that contributed 70% of the revenue, eco-agriculture and green energy services that contributed 2.92% of the revenue (mainly including buses and energy storage equipment under Gree Titanium), and small household appliances that contributed 2.18%.

In addition, industrial products and other businesses contribute a total of 23.6% of revenue, which is actually quite eye-catching.

A small number of industrial products mainly include compressors, motors, molds, etc., which belong to To B business, while other businesses mainly focus on purchasing upstream raw materials, mainly to play the role of bulk purchasing and lowering prices. After purchasing, they are sold to upstream processing enterprises, with a gross profit margin of only about 2%, which mainly plays a role in expanding income scale from a financial point of view.

It is worth noting that although the overall income of Gree Electric reached a new high in the first half of 2023, if the "other businesses" that hardly make money are deducted, the total remaining income has not actually returned to the level of the first half of 2019, and the income from air conditioning business alone is even worse than that in 2018 and 2019.

In addition to self-comparison, we can better understand what such data means by horizontally comparing Gree Electric with its old rival Midea Group. In the first half of 2023, Gree lost 98.006 billion yuan compared with Midea Group’s total revenue of 197.796 billion yuan.

Fairer, if the "other income" of the two companies is deducted, Gree has fallen behind the United States by 100.969 billion yuan, which is the biggest gap in the main income of the two companies in history.

So where is the difference between the 100 billion yuan?

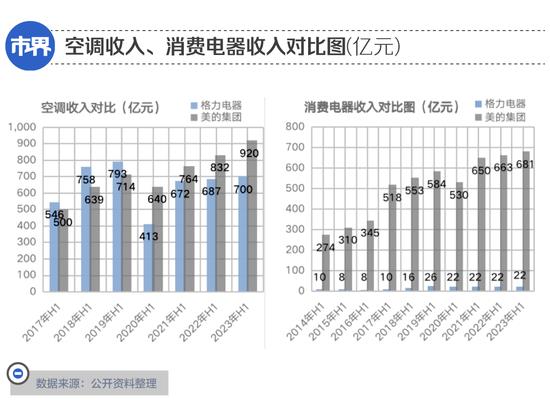

In terms of air-conditioning business, Gree has been at a disadvantage since 2020, and the gap has been widening in the past three years. The gap in the semi-annual report has expanded to 22 billion yuan; In the field of small household appliances, in the first half of 2023, Gree Electric’s income was only 2.177 billion yuan, while Midea Group’s income was 30 times higher than that of 68.136 billion yuan.

In addition to home appliances, Gree Electric’s industrial products, green energy and smart equipment businesses generated a total revenue of 8.7 billion yuan in the first half of 2023, which is about half of the revenue of Midea Group’s robots and automation systems.

It is worth noting that both companies are making efforts in the automation and intelligent production of To B, but the paths are different.

Judging from the semi-annual report, Gree Electric emphasized the technology and quality of core components such as compressors (core devices of air conditioners) and motors (power sources of electrical appliances), but Midea Group emphasized the complete solutions for different scenarios in the fields of medical care, entertainment and consumption.

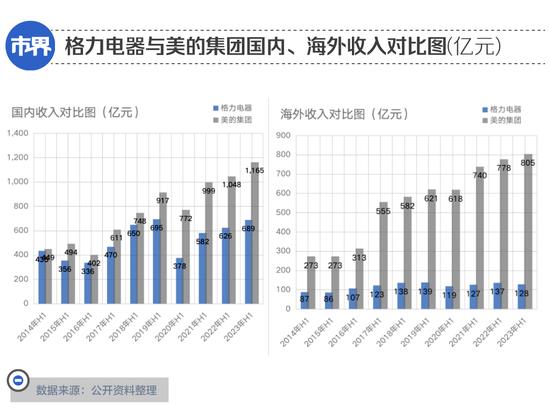

If we distinguish between domestic and foreign income, after deducting "other business", Gree Electric’s domestic income actually lagged behind that of the United States 10 years ago, but the gap was small. Until 2023, the gap in the semi-annual report has expanded to 47.5 billion yuan, the highest in the past years, equivalent to 59% of Gree’s only beauty.

The bigger gap is overseas income. The gap between the two has expanded from 18.5 billion yuan in the first half of 2014 to 67.7 billion yuan in the first half of 2023. Gree’s current overseas income is only equivalent to 16% of Midea Group.

At least in terms of scale, Gree Electric has indeed fallen behind Midea Group in terms of air conditioning, small household appliances and diversified businesses, and the gap has also reached a new height.

"Sequela" of Dealer’s Rebellion

In addition to the overall performance, a series of subtle changes can be seen in the semi-annual report in 2023, which may be related to the "rebellion" of some dealers in Gree Electric last year.

In the first half of 2023, the sales expenses in Gree Electric increased by 71.01% year-on-year. The semi-annual report showed that it was mainly due to the increase in product installation and maintenance fees, but the air-conditioning revenue in the current period only increased by 1.82% year-on-year, which was in sharp contrast.

Although in absolute terms, the sales expenses of 8.41 billion yuan in the first half of the year are not the highest in the semi-annual reports over the years, it is the first time to look through the financial reports over the years, like in the first half of 2023, because of the installation and maintenance costs, the sales expenses have risen sharply.

As a leader in the field of air conditioning, the probability of a sudden surge in maintenance costs due to quality problems in the first half of the year is not great, so it is more likely that the installation costs have increased substantially. But why did the air conditioner sell less than 2% more, and the sales cost rose by 71% because of the installation cost?

In fact, the after-sales business of air conditioners has always been the responsibility of distributors all over the country. They also manage the air conditioner sales business and after-sales business including installation and maintenance in the corresponding areas. When installation services occur, the distributors will charge certain fees from the air conditioner manufacturers, and they will also charge customers aerial work fees, material fees and so on according to the situation.

In September, 2022, Gree fell out with dealers in Hebei, who published a Notice, describing a series of inside information that Zhuhai Gree headquarters shut down the after-sales service management authority of Hebei Gree Company, and after Gree Zhuhai Hengge took over the after-sales service in this area, it proposed sales performance tasks for maintenance points, changed the preferential policies that Hebei Gree used to provide such as free overhead fees and free punching fees, and so on.

After the two parties parted ways, the new distributor that Gree Electric was looking for in Hebei surfaced-Eye-searching showed that Gree Zhuhai Hengge Digital Technology Co., Ltd. mentioned in the Notice was previously owned by Zhuhai Hengge Trading and Jiangsu Saifu Green Food Development Co., Ltd., but the latter withdrew in May this year and Xiamen Saifu Trading Co., Ltd. became the new shareholder.

It is noteworthy that Liu Qiangdong and ZhangZetian once appeared among the shareholders of Jiangsu Saif Green Food, but they withdrew from the shareholders in 2020. The legal representative of Xiamen Saif Trade, the new shareholder, is Zuo Yujie, just like Jiangsu Saif Green Food.

According to the public information, Zuo Yujie has a close relationship with JD.COM. He used to work in JD.COM and still serves as the chairman of Runjing Information Technology Co., Ltd., which is the operator of JD.COM Wine World, and JD.COM Wine World is an omni-channel wine retail enterprise invested by JD.COM.

In addition to the 71% increase in sales expenses, the contractual liabilities of Gree Electric (that is, the advance payment paid by dealers) rose by 79.7% to 28.972 billion yuan at the end of June 2023, while the operating cash inflow increased by 40% to 127.9 billion yuan year-on-year. It can be considered that the changes in important distribution channels have brought a series of effects, that is, new dealers have large-scale purchase demand, which brings considerable cash flow and contractual liabilities, and at the same time corresponds to the regional after-sales service system.

In addition, considering the above indicators comprehensively, there is another possibility, that is, delaying the recognition of income and recognizing expenses in advance.

In this case, a considerable part of the goods have been sent to the dealers, and the payment has been received, and the installation has been completed after the sales by the dealers. However, Gree Electric did not settle this part of the payment with the dealers for some reason, which led to the fact that it is still reflected in the books as contract liabilities rather than income. However, the installation expenses that have occurred have already been reflected in the sales expenses because they need to be included in the corresponding period, which leads to a huge difference between the increase of income and sales expenses.

In either case, the high probability is related to the change of dealers, and it can also be regarded as the sequela of the "rebellion" of important dealers in Gree Electric in 2022.

Gree still has its own advantages.

Even if the overall performance lags behind Midea Group, many indicators in the 2023 semi-annual report are affected by changes in dealers, but from many data, Gree still has its own advantages.

The first is ample cash in the account.

At the end of June, 2023, Gree’s book cash and wealth management reached about 200 billion yuan, more than all the cash and wealth management on the books of Midea and Haier combined, but it should also be noted that 64.219 billion yuan of them were restricted funds.

At the same time, the gross profit margin of Gree Electric’s air-conditioning business returned to a high level of 35.69% in the first half of 2023. In the same period, Midea Group’s air-conditioning gross profit margin was only 23.29%, while Haier Zhijia’s was 28.62%, which was related to Gree’s greater focus on air-conditioning, which led to higher overall asset operation efficiency, as well as a certain cost advantage gained by centralized procurement of raw materials, which was of course a direct manifestation of its brand premium.

If we compare the per capita income and per capita profit, Gree Electric will be the highest in 2022. Because of this, although the total revenue of Gree Electric and Midea Group in the first half of the year is nearly 100 billion yuan, the difference in net profit is only about 6 billion yuan. Haier Zhijia, whose income is 32% higher than that of Gree Electric, has a net profit of only 73% of that of Gree Electric.

These all point to one of Gree Electric’s greatest advantages-that is, it can earn more money with higher efficiency in the established field of air-conditioning business.

However, the capital market of "voting with your feet" only gives Gree Electric about half of the current market value of Midea Group, which shows that it is not enough to have a strong ability to make money in one field, and the scale of revenue is also very important.

In contrast, Midea Group seems to have chosen another path.

Ten years ago, Midea Group began to lay out multi-category household appliances and overseas business. Although at a certain stage, the product lines were messy and redundant, it could be improved through necessary simplification and transformation. The longer-term significance lies in broadening the possibilities and having a greater first-Mover advantage in related tracks. Especially when the external environment changes, such advantages may bring subversive development.

It’s not that Gree Electric doesn’t want to embrace diversity and look for the second or even third curve, but the exploration in these years has not been smooth. Compared with the traditional thinking, the early smart phone project was flooded, but the unreliable Yinlong was chosen for the new energy grand track, and the small household appliances business was slow to progress because it entered too late, not to mention the overseas market that could not open the situation by adopting conservative strategies.

Interestingly, just like Midea Group, which has developed a number of business segments as the driving force for subsequent growth, He Xiangjian also retired early and chose Fang Hongbo as his successor. On the other hand, in Gree Electric, the issue of successor has been unresolved, and 69-year-old Dong Mingzhu is still closely bound with brand IP and active in front of the stage.

The difference between the two can also be seen from the age of management. The average age of 16 Dong Jiangao in Gree Electric (one of whom has no information) is 57 years old, and only one of them, Dong Mingzhu, has an annual salary of more than 5 million yuan, with a salary of 11.42 million yuan in 2022.

In contrast, the average age of the 22 directors of Midea Group is 50 years old, and 8 of them earn more than 5 million yuan a year. Among them, the chairman Fang Hongbo earned 11.3 million yuan in 2022, while the average age of the 21 directors of Haier Zhijia is 52 years old, and no one earns more than 5 million yuan a year.

Even if we only consider the air-conditioning business, it is not difficult for Gree Electric to maintain single-digit growth, and it is understandable to describe it as a relatively stable and solid manufacturing industry. However, in order to break through the existing situation and catch up with the rhythm of the times again, Gree obviously has to continue to look for its own possibilities.

(Disclaimer: This article only represents the author’s point of view and does not represent the position of Sina. com. )