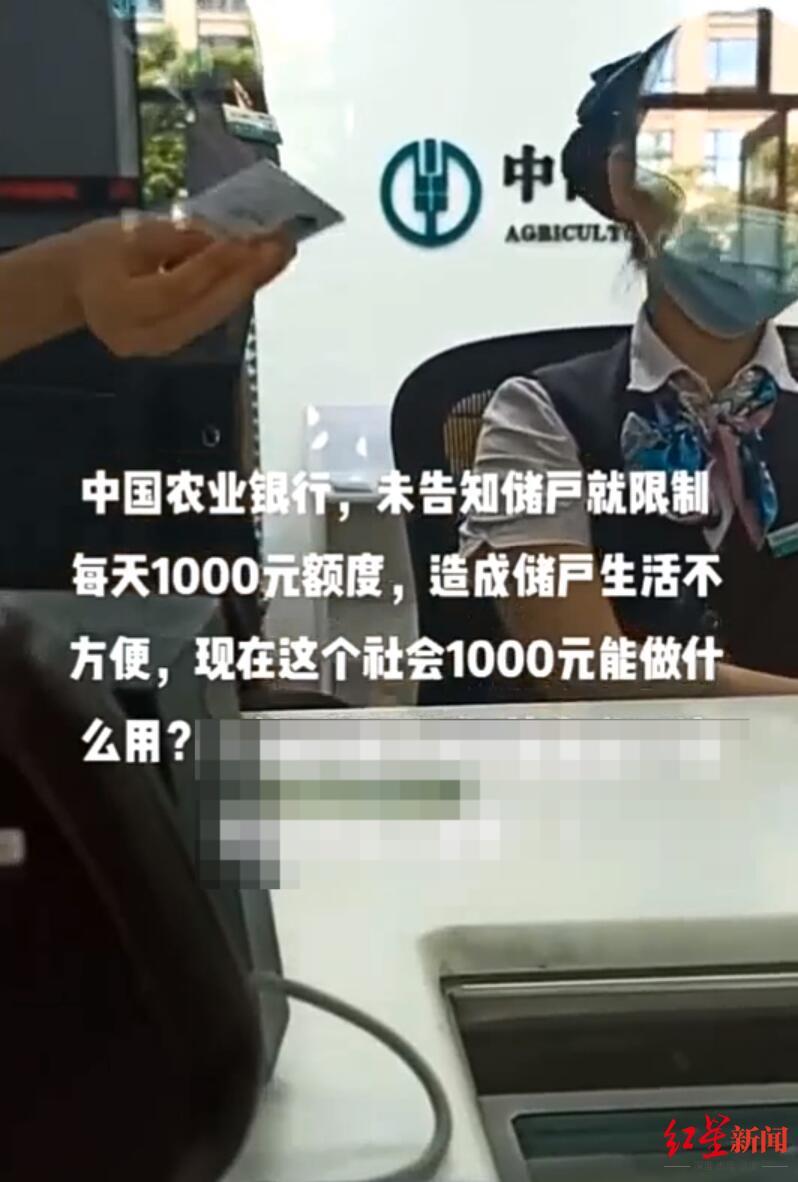

According to Beijing Youth Daily, on June 20th, a video of depositors 1000 yuan negotiating with bank staff over the bank card limit was circulated on the Internet. In the face of questions from depositors, the bank staff explained that this was automatically set by the system. According to the information revealed in the video, the depositor works in Shenzhen, has real estate in Jiujiang and lives here. Some netizens pointed out that this happened in Jiujiang Town, Nanhai District, Foshan City, Guangdong Province. On June 21st, the staff of Nanhai Jiangbin Sub-branch of Agricultural Bank of Jiujiang Town, Nanhai District, Foshan responded to the media that they had paid attention to the videos circulating on the Internet. Previously, all banks had designed data models to prevent telecom fraud according to the requirements of the regulatory authorities and in cooperation with the public security organs’ actions to crack down on telecom fraud. The data model matches the quota for customers according to their historical trading habits. The same thing has happened to other customers, and it is not just ABC. Customers who don’t use bank cards for a long time may find that there is a limit requirement for card-free payment.

Agricultural Bank of China makes every effort to prevent and control telecommunication network fraud.

The staff explained that the customer’s bank card in the video is not limited on the same day, which shows that this bank card is not commonly used. In this case, if customers need money urgently, they can handle it at the counter with their cards. If the customer finds that the bank card is limited, he can go to the counter to provide relevant supporting materials for withdrawal.

The reporter of Beijing Youth Daily called the customer phone number 95599 of China Agricultural Bank today and heard a message from an intelligent voice assistant: "If your bank card suddenly appears abnormal or your transaction is blocked recently, please say’ debit card is abnormal’." After the reporter said that "the debit card is abnormal", he heard a voice broadcast: "In order to effectively protect the safety of customers’ cards and funds, our bank is making every effort to prevent and control telecommunication network fraud. If your bank card suddenly appears abnormal in use or transaction is restricted recently, please bring your bank card and valid ID card to the nearest outlet to verify the specific reasons and solutions. Thank you for your cooperation. "

A number of banks issued announcements to reduce the non-counter business limit of some individual customers.

According to the Beijing Youth Daily reporter, it is not new that personal accounts are restricted for various reasons, and it does not only exist in the Agricultural Bank of China. In recent years, all major social platforms have netizens who "spit" their bank accounts suddenly restricted, and the banks involved are not only state-owned big banks but also local small banks.

Some people say that accounts that can usually transfer hundreds of thousands of money can suddenly only transfer up to 5,000; Some netizens’ bank cards exceed 1000 yuan’s, and no matter transfer or payment; Someone’s credit card has been suspended, and the bank requires a formal VAT invoice to resume it; Some people use long-term idle bank cards to recharge their mobile phones, only to find that 20 yuan has exceeded the limit. ……

Although the account is restricted in different situations, these customers will be told by the bank that there are abnormal transactions in the account. In order to prevent telecom fraud and protect the safety of customers’ funds, relevant restrictions are taken.

Many banks have also issued announcements to reduce the off-counter trading limit of some individual customers.

From December 21st, 2021, Fujian Straits Bank will handle the off-counter transfer of RMB personal current settlement accounts whose average daily balance in 2021 is less than that in 1000 yuan and the opening date is July 1st, 2020, according to the adjusted transfer limit. Online banking+mobile banking channel: the daily cumulative limit is 4,000 yuan, and the annual cumulative limit is 1.2 million yuan. Third-party channels WeChat and Alipay: the daily cumulative limit is 1000 yuan.

On April 2 this year, the Agricultural Bank of China issued the "Announcement on Lowering the Trading Limits of Some Customers’ Online Financial Channels". The announcement said, "Recently, telecommunication network fraud has occurred frequently. In order to ensure the safety of customers’ accounts and funds and implement the regulatory requirements, our bank has successively adjusted the personal online banking and bank transfer limits of some customers."

Shanghai Pudong Development Bank Hangzhou Branch, Chengdu Branch, Changsha Branch and Fuzhou Branch have also issued relevant announcements this year. These branches said that in the near future, according to the basic information reserved by customers in the bank and the use of accounts, the off-counter business limit of personal bank settlement accounts will be appropriately adjusted.

According to the Chengdu Branch of Pudong Development Bank, the limit of accounts that have not been used for a long time may be lowered, and the limit will be reduced to one-day 1000 yuan, compared with 50,000 yuan for customers who have independently opened non-counter transactions in mobile banking.

Judging from the announcements issued by these banks, the restricted businesses are all "non-counter businesses", which are simply businesses that are not handled at the bank counter, including but not limited to online banking, mobile banking, gateway payment, express payment, point-of-sale (POS), self-service teller machines (ATM) and other businesses.

The "Card Breaking Action" launched a year to clean up 1.48 billion abnormal bank cards.

Many people in the banking industry said that this is actually a "broken card" action requirement. On October 10, 2020, the State Council held an inter-ministerial joint meeting to crack down on new illegal crimes in telecommunications networks, and decided to launch a nationwide "card-breaking" operation with the main content of cracking down, governing and punishing illegal criminal gangs that started and sold telephone cards and bank cards, and to clean up and rectify fraudulent telephone cards, Internet of Things cards and related Internet accounts according to law. In the "card-breaking" operation, banks and payment institutions also need to clean up abnormal bank cards such as long-term fixed accounts, "one person with multiple cards" and frequent loss reporting and replacement of cards.

In November last year, the central bank announced the results of the "card-breaking" operation in the past year. In this "card-breaking" operation, the central bank urged banks and payment institutions to clean up 1.48 billion abnormal bank cards such as long-term fixed accounts, "one person with multiple cards" and frequent loss reporting and replacement cards; Guide commercial banks to establish a fraud-related risk monitoring and interception model, "quickly monitor and intercept" fraud-related high-risk transactions, and intercept fraud-related funds of 1 billion yuan in real time.

Restricted customers can bring documents and materials to the outlets to verify and solve them.

If customers find that their use of cards is limited, they can’t just worry. The Agricultural Bank of China announced that if customers need to increase the online transfer limit, please bring valid identity documents and bank cards to any branch of the bank. Due to local regulatory requirements, some areas may need to provide other supporting certification materials, and you can consult local outlets for details. If you can’t go to the outlet for quota adjustment due to special circumstances, you can call the customer service telephone of Agricultural Bank of China for consultation.

The relevant branches of Shanghai Pudong Development Bank also indicated that if the customer’s account is prompted to exceed the transaction limit and there is a real need to increase the amount of non-counter business, they can go to the branch or any business outlet for identity verification with their original valid identity documents, real-name mobile phones and bank cards.

Which customers and accounts will be restricted? Four situations are easy to "catch"

Ms. Li, who has worked in the front line of banks for many years, told the Beijing Youth Daily reporter that according to her experience, bank cards were suddenly restricted, and there were mostly four abnormal situations.

The first is that the customer information reserved by the bank is not perfect. For example, the customer certificate is overdue and the customer information is incomplete. Many banks’ systems regularly screen out such customers and restrict non-counter business in batches. She reminded everyone that if you change your new ID card, you must update the bank reservation information in time. Mobile banking in most banks can be updated, and you can also go to the bank counter to handle it.

The second is that day trading triggers the early warning of bank risk control systems such as anti-money laundering and anti-fraud. In order to evade taxes, some merchants will use personal accounts and corporate accounts to return their accounts; Some people keep brushing pos machines to cash in credit cards; There are also people who use Taobao to swipe their bills or participate in online gambling and buying and selling virtual currency. Once these illegal activities are identified by the system, they will definitely be restricted. After the early warning of the system, some banks directly restricted the related account transactions, and customers need to take the initiative to contact the bank to understand what is going on. Banks with better service will take the initiative to send SMS notifications to customers, and some bank staff will call customers to verify.

System identification can also lead to accidental injury. Ms. Li suggested that when receiving the verification call from the bank, you must actively cooperate and provide proof such as identity documents, running water and invoices when necessary. At the same time, you should take good care of your bank card, don’t rent or lend it to others, and don’t participate in illegal activities.

The third situation is that the bank card is not used for a long time and its status is abnormal. For example, if there is no transaction for six months after the card is opened, it will limit off-counter transactions; If the bank card is not used for a long time, and the account balance is small, it will be restricted if it is in a sleep state. If customers want to continue to use or activate, they can consult the bank; If you really don’t need to use it, you’d better close the account as soon as possible.

The fourth situation is that there is no problem with my bank account, but there is something wrong with my counterparty’s account. If you have transactions such as transfer with such accounts, you will also be implicated and restricted. This kind of situation is rare, and it often needs the cooperation of other departments to lift the restrictions, which cannot be solved by banks alone.

The normal use of cards by most bank customers is not affected.

Dong Ximiao, chief researcher of Zhaolian Finance and part-time researcher of Fudan University Financial Research Institute, pointed out that long-term idle sleep accounts or small accounts may be used by telecom fraudsters, threatening users’ financial security and information security, and a few users are identified as non-compliant transactions because of too frequent transactions. In addition to targeting specific users, the quota policies of many banks are only aimed at areas where telecom fraud is rampant.

Dong Ximiao believes that under the current policy, the vast majority of bank users will not be affected by the quota adjustment, and users need not be overly anxious or over-interpreted.

At the same time, Dong Ximiao reminded cardholders to strengthen the risk management of accounts, cancel the bank cards that have not been used for a long time in time, and more importantly, don’t lend, rent or sell the bank accounts to prevent others from using the bank cards to engage in illegal activities.

Su Xiaorui, a senior analyst in the financial industry of Analysys, believes that in recent years, the phenomenon of fraudulent use of bank cards or theft of funds in cards has occurred frequently, which has brought challenges to the risk prevention of banks and the safety of customers’ funds. The future online channel trading limit is expected to continue in the short term, but in the medium and long term, it is not excluded that banks will achieve a dynamic balance between business risk prevention and user convenience by improving risk control and financial technology.

Original title: 15th floor finance | bank card inexplicable limit 1000 yuan? Banks: preventing and controlling telecom fraud