BEIJING, Beijing, May 9 (Reporter Li Jinlei) As long as you pay tens of yuan of agency fees every month, you can help you pay social security online. This kind of online service to help individuals pay social security is rising day by day. Many companies have opened Taobao shops, and some have even opened WeChat WeChat official account, which can pay social security, and even developed related apps.

With a light finger, you can pay social security without leaving home. Is this online social security payment service reliable? Is it legal and compliant? What are the risks? The reporter from Zhongxin. com conducted an investigation into this.

It is advertised that paying social security is as simple as shopping.

— — Social security can be remitted at 19.9 yuan per month.

Ms. Tian, who runs an online shop in Beijing, can’t pay social security in Beijing by herself because her household registration is in other places, so she thought of looking for the service of paying social security online. "I just want to find that kind of company, pay it tens of yuan a month, and then help me pay social security in Beijing."

The reporter from Zhongxin. com noticed that due to the existence of demand, the service of helping individuals to pay social security online is on the rise. Many companies have opened Taobao shops, some have also opened WeChat WeChat official account, which can pay social security, and even developed an APP. The process of purchasing these social security services is generally simple, and the service fee is only tens of yuan.

The reporter searched for "social security payment" on Taobao, and it was easy to find hundreds of related shops engaged in social security payment. Among them, the turnover of a self-proclaimed "Internet social security service leader" in the top rank has reached 2,820.

The reporter consulted a number of social security paying businesses on the grounds of going to Beijing for social security. The customer service staff of the above-mentioned Taobao shop merchants told the reporter that personal social security payment is mainly for people who don’t want to pay social security during their resignation and change jobs, and have no unit to pay social security. As long as they submit basic information, they will pay a monthly fee of 19.9 yuan for five insurances. Social security payment is as simple as online shopping and can be paid online.

The customer service staff of another company that opened the WeChat terminal to pay social security services told reporters that the company was "certified and licensed by Ministry of Human Resources and Social Security of the People’s Republic of China, and the social security funds were supervised by China Merchants Bank, so it was convenient to operate on WeChat terminal to meet the needs of individual social security payment". The minimum service fee paid by personal social security is 80 yuan/month. Newly registered customers will also be given vouchers from 30 yuan, and they can submit orders directly on WeChat for payment.

Claiming to be legal without providing a labor contract

— — Actually affiliated with the company name.

The reporter of Zhongxin. com found that the company that handles social security payment online will not sign a labor contract with the demander, but requires a service agreement. The agreement clearly emphasizes that there is no labor relationship between the two parties.

At the request of the reporter, the staff of the above-mentioned WeChat payment social security company sent a user service agreement to the reporter. This agreement shows: "Party B is only an agent service provider for social insurance and provident fund, and is only responsible for providing social insurance, provident fund participation and related services for Party A. It has no labor relationship with Party A and its entrusted participating members, and is not responsible for the actions of Party A and its entrusted participating members."

In the face of a reporter’s question about whether it is legal to pay social security without signing a labor contract, the staff of the company said: "There is no labour relation between you and our company, but only pay social security, so you can’t provide a labor contract. The remittance is under the name of our company, which is legal. You can check in the Social Security Bureau that you paid under our company account. "

"The labor contract and any proof of official seal are not issued." The customer service staff of the above-mentioned Taobao shop merchants told reporters. The reporter found that the agency service agreement sent by this company also clearly stated: "Party A and Party B only have the agency service relationship of social security affairs, and there is no subordinate relationship or labor relationship. Party B shall not arrange Party A’s specific work, and Party A shall not carry out work in the name of Party B, nor shall it claim the rights of labor relations from Party B, including but not limited to the post, salary, length of service, annual leave, labor contract, etc."

The customer service staff said that after the successful payment, you can log on to the Beijing social security online service platform, and find the five insurance status and payment company in the personal basic information query management, and the payment details are queried every other month.

Official: It is illegal to pay social security by affiliated agency.

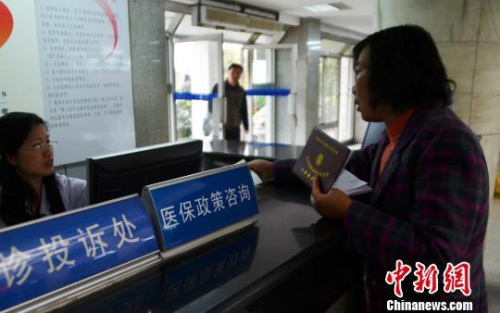

Is this online social security payment service reliable? Is it legal and compliant? The reporter of Zhongxin. com called the human resources and social security service hotline 12333 for consultation. The hotline staff told reporters that employees must sign labor contracts and have labor relations with employers before they can pay social insurance through their units. The two sides did not establish a labor contract relationship, but paid social security by calling an agency, which is illegal and not allowed by the policy.

Chu Fuling, director of the China Social Security Research Center of the Central University of Finance and Economics, told the reporter of Zhongxin. com that the regulations and requirements for participating in insurance as an individual vary from place to place, but there are usually restrictions on household registration. Generally speaking, if a foreign registered permanent residence does not have a work unit in the place of residence, it is impossible to get social security.

For this kind of online social security payment company, Chu Fuling believes that the workers did not sign labor contracts with them, nor did they work and receive wages in the company. The agency company paid social security for them by collecting headcount fees, which is suspected of fictitious labor relations and has certain risks and problems. This kind of illegal behavior needs to be regulated.

The reporter noted that the "Social Insurance Law" clearly stipulates that if social insurance benefits are defrauded by fraud, forged certification materials or other means, the social insurance administrative department shall order it to return the defrauded social insurance benefits and impose a fine of more than two times and less than five times the amount defrauded.

So how can people who can’t pay social security through their work units be insured? According to the Social Insurance Law, individual industrial and commercial households without employees who voluntarily participate in social insurance, part-time employees who do not participate in social insurance in the employing unit and other flexible employees shall apply to the social insurance agency for social insurance registration.

Taking Beijing as an example, the staff of the 12333 hotline explained that people with foreign hukou can’t get social security if they don’t have a work unit in Beijing. However, local urban hukou personnel in Beijing who have no work units can participate in social security through talent service centers or employment service centers, but they can only participate in pension, medical care and unemployment insurance.